BOFIT Weekly Review 32/2022

Yuan-euro exchange rate hits levels not seen for years

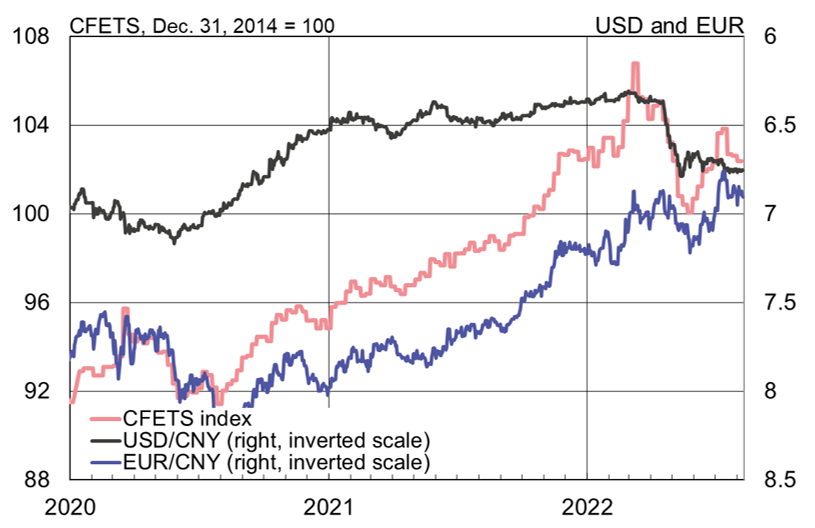

The yuan has appreciated substantially against the euro over the past two years, a trend that has continued throughout this summer. At the beginning of July, the euro stood at 6.7 against the yuan. The exchange rate was last this strong in 2015, when it was 6.5.

In contrast, the yuan has shown no signs of appreciation against the US dollar since a brief weakening at the start of May. Between end-2020 and May this year, the yuan-dollar rate fluctuated in the 6.3–6.5 range. In recent months, it has bounced between 6.7 and 6.8. Despite the recent depreciation, the yuan-dollar exchange rate is still stronger than in 2019–2020.

Recently both the yuan-dollar rate and yuan-euro rates have been almost at the same level. This is due to the weakening of the euro as it reached parity with the dollar in July for the first time since 2002.

In recent weeks, the yuan has also gained value when measured by the CFETS index, a currency basket weighted by main trading partners. The US dollar and the euro have the largest weights in the index.

The appreciation of the yuan against the euro has made products imported from Europe cheaper for Chinese consumers, while imported Chinese products have become more expensive for European consumers. While this situation could hurt China’s export industries, which are already suffering from the impacts of covid and covid lockdowns, the dollar remains China’s most important foreign trade currency.

In recent months, the yuan has appreciated against the euro but not the US dollar.

Sources: Macrobond, CFETS and BOFIT.