BOFIT Weekly Review 29/2022

Russian federal budget revenues continue to deteriorate

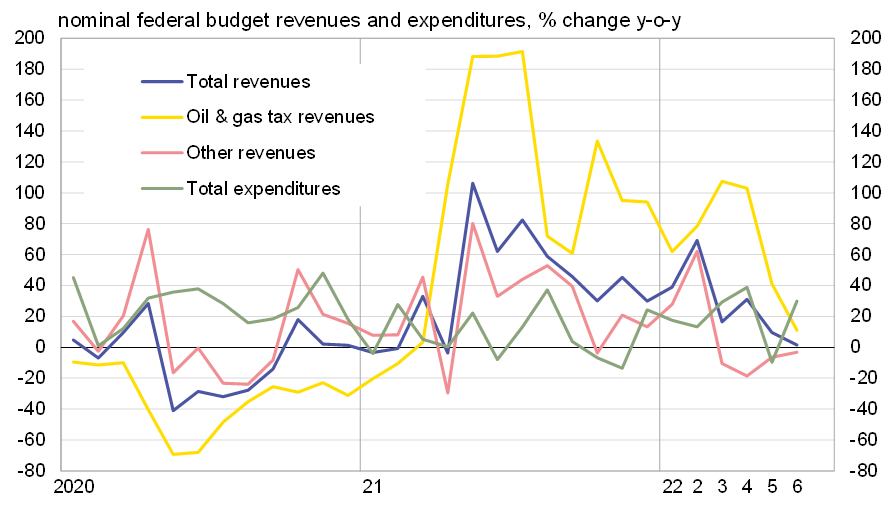

Nominal revenues to the federal budget in June were up by a meagre 1.5 % y-o-y. This translates to a very large drop in real terms as the 12-month rise in consumer prices and industrial producer prices averaged 14 % in June.

Revenues from production and export taxes on the oil & gas industry, which are largely set based on global prices in dollars, were now up by just over 10 % y-o-y. The world market price for Urals-blend oil in May and June was up by about 20 % y-o-y, but strong ruble appreciation along with a contraction in production and exports of gas & oil had a diminishing effect on these budget revenues. Other federal budget revenues declined in June by 3 % y-o-y, a smaller drop than in previous months.

Following a May dip, federal budget spending rose sharply in June. The budget was still in surplus for the first six months of this year while the last 12-month surplus contracted in June to less than 1 % of GDP.

The budget revenue outlook for the rest of this year is lame. Revenues other than those from oil & gas tax revenues (55 % of federal budget revenues in January-June) decrease as the country slides into recession. Government revenues from oil & gas taxes will be supported by the price of Urals as long as the price remains at the rather high level of recent months (even if Urals is discounted on world markets due to sanctions). On the other hand, revenues are depressed by lower oil & gas output, reduced exports and the high ruble exchange rate compared to last year.

Given Russia’s weak budget revenue prospects, e.g. the finance ministry expects the federal budget deficit to exceed 1 % of GDP even if the rise of budget spending with its supplements would remain well below the pace of inflation. Resolving the setup between budget deficit and increases in spending may become even more challenging for the entire government budget sector if non-oil revenues to the consolidated budget (federal, regional and municipal budgets plus budgets of state social funds) drop off substantially. These revenues have accounted for about 80 % of total consolidated budget revenues. The budgets of regions and municipalities, as well as social fund budgets, are to a large extent reliant on transfers from the federal budget and have few possibilities to take on new debt.

The 12-month change in Russia’s nominal federal budget revenues declined close to zero

Sources: Russian Ministry of Finance and BOFIT.