BOFIT Weekly Review 26/2022

India tightens its monetary policy

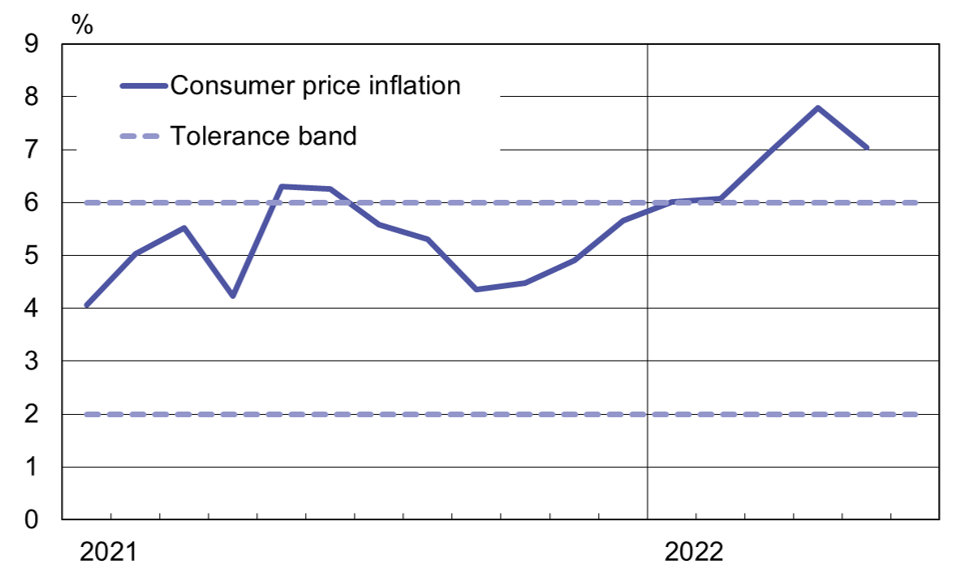

The Central Bank of India’s Monetary Policy Committee (MPC) decided to raise the repo rate, India’s main monetary policy rate, to 4.9 % on June 6. The committee also announced it would focus on dismantling earlier stimulus measures to bring inflation back into the target band (between 2 % and 6 %) while still working to sustain economic growth. Inflation in March-May ran at around 7 % a year, still well above the upper target level. Monetary policy has tightened sharply since the decision at the May MPC meeting to wind down monetary stimulus measures as the latest wave in the covid pandemic began to subside.

According to the MPC, the acceleration in India’s inflation rate reflects, among other things, the rise in global commodity prices and global supply chain disruptions caused by the pandemic. Prices have risen across the board in recent months, affecting prices of food, fuel and many other consumer products. The Central Bank of India expects inflation to be back within its target band within the coming six months. The inflation outlook, however, remains uncertain due to global geopolitical tensions and turmoil in global commodity markets.

The Indian economy has grown rapidly in recent months. Recent reports indicate that economic growth reached 8.7 % for fiscal year 2021‒2022 (April 2021 ‒ March 2022), putting GDP above its pre-pandemic levels. Monthly indicators also suggest that economic growth remained brisk throughout the spring. Growth was particularly robust in the service sector as covid restrictions eased. The MPC expects the pace of GDP growth to be 7.2 % in the current fiscal year 2022‒2023.

Inflation has exceeded the upper limit of the Central Bank of India’s inflation target range for much of this year.

Sources: India’s Ministry of Statistics and Programme Implementation, Macrobond and BOFIT.