BOFIT Weekly Review 18/2022

Yuan loses ground against the US dollar

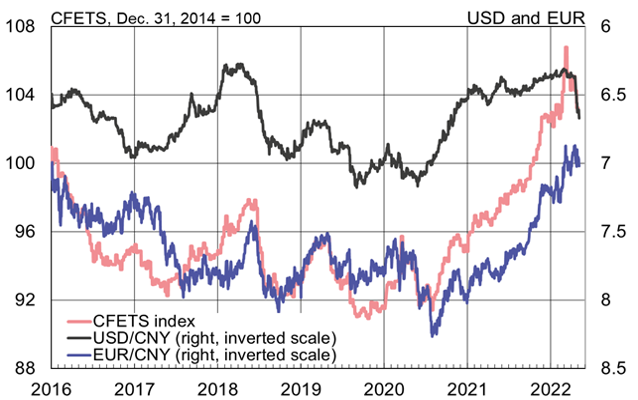

The yuan has been on a downward trend since mid-April, losing 5 % of its value against the dollar and 2 % against the euro. China also releases data on the performance of the yuan against a trade-weighted currency basket with a delay of a few days. The China Foreign Exchange Trading System (CFETS) RMB index shows that the yuan lost about 2 % of its value in the final two weeks of April. The falling exchange rate reflects growing global uncertainty, China’s weakening growth prospects and rising interest rates outside China that could trigger capital outflows. The yield on the US 10-year treasury note, now around 3 %, exceeds that of China’s government bond for the first time since 2010. In February-March, the net flow of foreign portfolio investment to mainland China’s equity and bond markets turned negative.

At the end of April, the PBoC announced that it was lowering the foreign currency deposit reserve requirement for commercial banks from 9 % to 8 % in mid-May. The slight freeing up of bank forex reserves could relieve some depreciation pressure on the yuan. The PBoC can, as needed, intervene to prevent violent swings in the exchange rate through e.g. issuing guidance orders on the forex trading of commercial banks.

The yuan has depreciated sharply against the dollar in recent weeks

Sources: Macrobond, CFETS and BOFIT.