BOFIT Weekly Review 17/2022

Timely CBR support measures avert banking sector panic

Russia’s invasion of Ukraine and the new Western sanctions that followed threatened to cause a massive run on bank deposits in Russia. The Central Bank of Russia responded with aggressive measures that included raising its key rate, imposing capital controls, shutting down the Moscow exchange for nearly a month, providing extra liquidity to banks, as well as temporarily reducing supervisory measures for banks to support the banking sector. Thanks to the CBR’s timely moves, conditions on Russia’s financial markets stabilised last month.

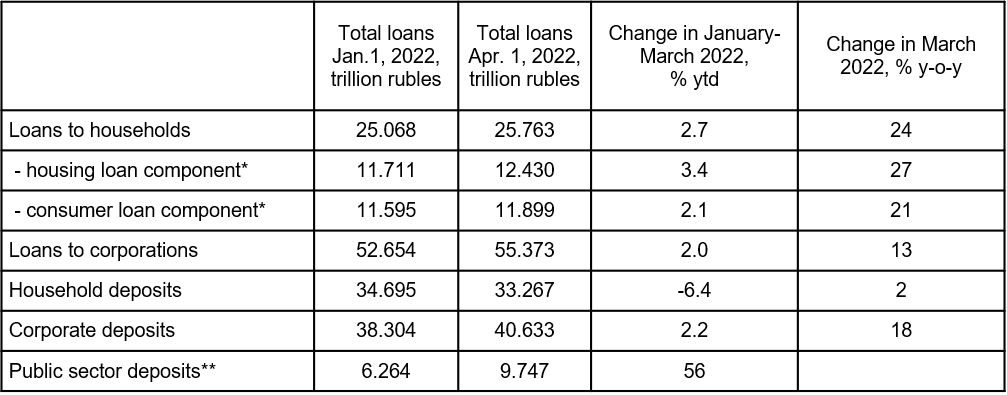

A striking change is the brevity of banking sector data released by the CBR for February and March. They show household bank deposits contracting in February by a record 3.5 % m-o-m, then plateauing in March. As of end-March, household bank deposits were about the same as at the start of the month. Due to the lack of alternative investment opportunities and the offering of high deposit interest rates, banks managed to attract ruble deposits. The stock of household bank deposits at the end of March was down just 6.4 % from the start of the year.

The stock of corporate bank deposits remained essentially unchanged during February and March. In particular, the figures for corporate deposits revealed a shift from forex deposits to ruble deposits. The shift was largely driven by the government requirement that firms convert most of their export earnings to rubles. Growth in budget revenues led to the explosion of public sector bank deposits in March.

Rising interest rates and general uncertainty are reflected in bank lending. While the stock of corporate lending was largely unchanged in March, the CBR estimates that new lending was down by about a third. In addition, new consumer loans were also down by about a third from January. Numerous government interest subsidy programmes and loan repayment holidays have supported corporate and housing lending. Due to extremely rapid growth last year (BOFIT Weekly 7/2022), on-year growth in total bank lending remained high in the first quarter of this year.

Key indicators for Russia’s banking sector in the first quarter of 2022

Sources: Central Bank of Russia and BOFIT. Figures include loans and deposits in all currencies.

* February ** compiled from multiple sources.