BOFIT Weekly Review 14/2022

Growth of China’s CIPS payment system remained brisk last year

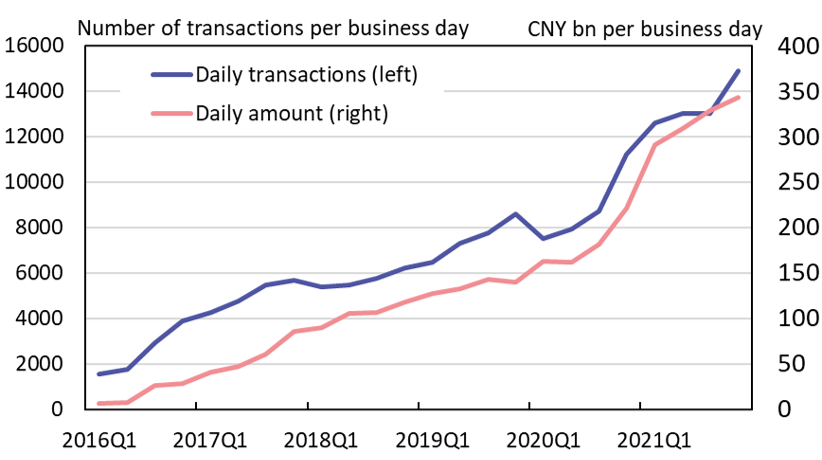

The People’s Bank of China reports that its yuan-based Cross-border International Payment System (CIPS) handled nearly 15,000 payments a day in the fourth quarter of 2021. The system processes on average transactions worth 343 billion yuan each business day. The number of payment transfers grew by about 30 % y-o-y, while their cumulative value was up by around 50 %. The pace of growth in both volume and value matched that of 2020. While very little information about CIPS transactions is published, it is known that growth has been partly fuelled by the relaxing of capital controls between Hong Kong and mainland China through such arrangements as the Stock Connect and Bond Connect programmes between exchanges.

CIPS, launched in autumn 2015, is primarily intended to promote cross-border payments in yuan internationally. In its current form, CIPS only can be used for yuan payments. The system includes both direct participant and indirect participant banks. Direct participant banks act as payment hubs that route payments of indirect participant banks.

According to the CIPS website, the system comprised 76 direct participant banks at the end of March 2022. Of those banks, 26 were Chinese banks or payment firms operating inside China, 35 were foreign subsidiaries of Chinese banks operating abroad and 13 were Chinese subsidiaries of foreign banks operating in China. In addition to these participants, the Hong Kong monetary authority’s Central Moneymarkets Unit, a clearing and settlement facility for exchange fund bills and notes, is also a direct participant. Most of the direct participants located abroad (i.e. foreign subsidiaries of Chinese banks) are sited in international financial hubs, but there are also direct participants in countries such as Laos, Hungary, Russia and Zambia. As of end-March, there was a total of 1,228 indirect participant banks operating in 104 countries. Most banks were based in China (542) or elsewhere in Asia (404). There were 169 indirect participant banks in Europe, 44 in Africa and 69 elsewhere in the world.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) reports that the yuan was the world’s fifth-most-used payment currency as of end-February, accounting for over 2 % of all international payment traffic. That share surpassed 3 % in January. CIPS and SWIFT are fundamentally different systems. CIPS is built for transferring money, while SWIFT transmits payment information, and does not perform clearing or settlement functions. In reality, CIPS and SWIFT are mutually supporting. CIPS relies heavily on SWIFT for transmission of payment information. For example, all participating Russian banks are indirect participants in CIPS and must transmit their payments information via SWIFT.

Use of China’s yuan-based Cross-border International Payments System (CIPS) has grown rapidly since it was launched in late 2015

Sources: CIPS, People’s Bank of China and BOFIT.