BOFIT Weekly Review 14/2022

China stays with its diversified energy import strategy; natural gas consumption and imports on the rise

China is the world’s biggest energy consumer. It also remains by far the largest consumer of coal for primary energy production (56 % of energy consumption last year). China’s next largest primary energy sources are crude oil (nearly 20 %), natural gas and hydropower (each about 8 %). Despite the world’s largest renewable energy production capacity, renewables still satisfy a relatively small slice of consumption. As growth of energy consumption in China has outstripped production, the country’s dependence on fossil fuel imports has risen.

China’s coal consumption was up by nearly 5 % last year. Most of the coal consumption was filled domestically, as China last year produced over 4 billion metric tons of coal. Coal imports last year rose to 320 million tons (7 % of consumption), an increase of more than 6 % y-o-y. China imposed a ban on Australian coal imports in 2020 and shifted its supply emphasis to Indonesia, which last year accounted for 60 % of coal imports. Russia was the next largest coal supplier, accounting for about 15 % of China’s coal imports last year.

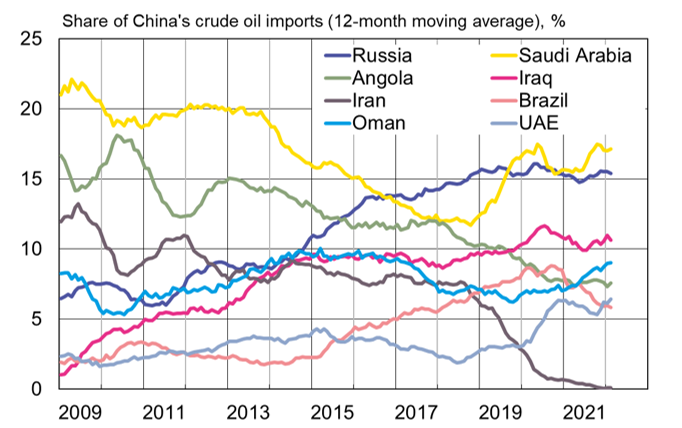

China’s crude oil consumption rose by 4 % last year. China has proven oil reserves of 26 billion barrels (1.5 % of global reserves), and its domestic production was sufficient to cover 28 % of the country’s oil consumption last year. China, the world’s largest oil importer since 2017, last year imported 510 million tons of crude oil (over 10 million barrels a day), a 7 % drop from 2020. China typically ramps up its oil imports when world oil prices are low, taking the opportunity to restock its national reserves. When prices rise on the world market, China accordingly reduces its import volumes. With crude oil, in particular, the international supply sources are highly diversified to prevent overdependence on a particular supplier. Saudi Arabia continues to maintain its status as China’s largest oil supplier. Last year, Saudi Arabia accounted for about 17 % of China’s supply, Russia 15 % and Iraq 10 %. Due to US sanctions imposed on Iranian oil imports at the end of 2018, China’s Iranian oil imports have collapsed (according to official figures). It is a poorly kept secret, however, that many small refiners in China import Iranian oil, but declare as the country of origin a third country such as Oman, UAE or Malaysia.

Natural gas consumption in China rose last year by 13 %. Domestic production covered nearly 60 % of consumption. Over two-thirds of China’s natural gas imports last year came in the form of liquefied natural gas (LNG). China last year imported 18 % more LNG than in 2020, while pipeline gas imports were up by 22 %. Nearly 40 % of China’s LNG supplies last year were imported from Australia. The US produced 12 % of China’s LNG imports, Qatar 11 % and Malaysia 10 %. Russia accounted for less than 6 % of China’s LNG imports last year. China also gets pipeline gas from Central Asia, Myanmar and Russia. Turkmenistan provided nearly 60% of pipeline gas last year, followed by Russia at 18 % and Kazakhstan at 10 %. Russia’s share of pipeline gas imports has soared after Power of Siberia, the first gas pipeline between the two countries, came on stream in late 2019.

China pursues a diversified crude oil import strategy

Sources: China Customs, CEIC and BOFIT.