BOFIT Weekly Review 05/2022

Ruble continues to weaken despite higher oil prices

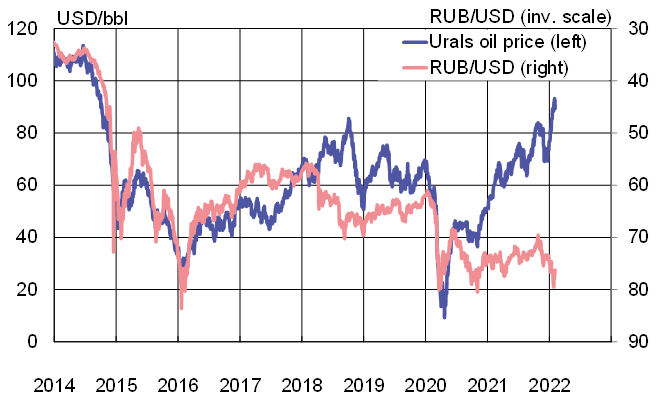

The world-market price of Urals-grade crude oil has soared in recent weeks, breaking the $90-a-barrel barrier in late January. Oil prices have not been this high since autumn 2014. Nevertheless, the ruble’s exchange rate has continued to decline, reaching near-record lows against the US dollar. The ruble averaged 77 rubles to the dollar this week, while the euro-ruble rate has been about 86. The Central Bank of Russia announced on January 24 that it was temporarily suspending its “fiscal rule” currency-buying on behalf of the finance ministry to rein in financial market volatility.

Most of the ruble’s drop reflects the recent intensification of geopolitical tensions. The expectations of monetary policy tightening in the US have caused depreciation pressures on many emerging-economy currencies. Russian economy also faces uncertainty from the sharp increase in covid infections in recent weeks.

Despite soaring oil prices, geopolitical risks have driven down the dollar-ruble exchange rate

Sources: Reuters, BOFIT.