BOFIT Weekly Review 4/2022

China’s central bank cuts interest rates to deal with slowdown in lending and economic growth

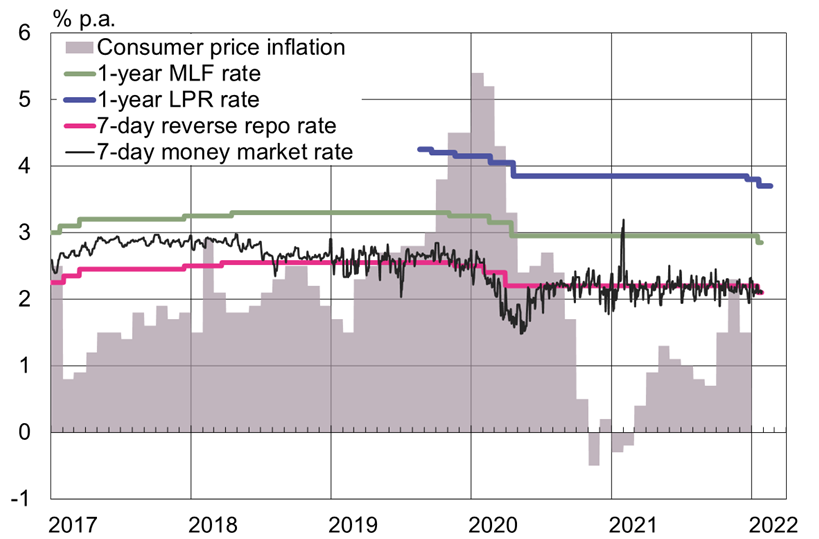

On the same day that the National Bureau of Statistics released its December economic figures (Jan. 17), the People’s Bank of China lowered its key reference rates. Both the reverse repo rate used in open market operations and rates of the medium-term lending facility (MLF) programme were cut by 10 basis points. The PBoC said it was going to use its monetary toolbox more widely this year in order to avoid a collapse in lending, as well as to support economic growth and stability. The growth in the bank loan stock slowed throughout 2021.

Although bank reserve requirements were lowered already in December (BOFIT Weekly 50/2021), the rate cuts were the first since spring 2020 when the covid crisis hit China. The 1-week reverse repo rate fell to 2.1 % and 2-week rate to 2.25 %. The central bank’s MLF programme provides credit to commercial banks against collateral. The one-year MLF rate was lowered to 2.85 %. New MLF lending in January amounted to 700 billion yuan, which exceeded the 500 billion yuan in maturing MLF loans. The central bank typically boosts liquidity ahead of the Chinese Lunar New Year in anticipation of increased money demand. This year, the week-long holiday begins on January 31.

The reference loan prime rate (LPR) was also lowered. The one-year LPR was cut by five basis points already in December and another 10 basis points in January to its current level of 3.7 %. The 5-year LPR, which is the reference rate for housing loans, was lowered in January by five basis points to 4.6 %. The relatively small reduction is seen as a signal that the government wants to support the market for housing loans, but is unwilling to provide broader stimulus to the heavily-indebted real estate sector. The drop in monetary policy rates is also reflected in bond rates. In these last days of January, the one-year government bond rate stands at 2 % and the rate for corporate bonds with AAA ratings are averaging 2.5 %.

The current modest inflation does not constrain accommodative monetary policy. Consumer price inflation slowed from 2.3 % in November to just 1.5 % in December. Despite waning acceleration in producer prices, producer price inflation was still 10.3 % in December. For all of 2021, the rise in consumer prices was just 0.9 %, a level well below the 3 % target ceiling set for last year.

The stock of bank loans grew by 11.3 % last year, down from 12.5 % in 2020. The growth rate was below the 12.8 % nominal GDP growth in 2021. Growth in the stock of household credit (mainly housing loans) slowed faster than in the stock of corporate loans. The PBoC’s broad measure of aggregate financing to the real economy (AFRE) grew last year by 10.3 %, down from 13.3 % in 2020. Growth in the stock of corporate bonds slowed substantially and the contraction in the stock of shadow banking sector instruments accelerated. At the end of last year, the PBoC’s AFRE measure stood at 275 % of GDP, a 6 percentage point decrease from a year earlier.

Policy rates, money market rates and consumer price inflation.

Sources: CEIC, PBoC, NBS, National Interbank Funding Center and BOFIT.