BOFIT Weekly Review 02/2022

China tries to boost international investor interest in green bonds

In April 2021, China harmonised its national criteria for determining the activities that qualify for green bond status. The People’s Bank of China, in conjunction with the National Development and Reform Commission (NDRC) and the China Securities Regulatory Commission (CSRC), published the 2021 edition of the Green Bond Endorsed Projects Catalogue. Suitable projects categorised as eligible for green investment include energy saving technologies, elimination or monitoring of emissions, protection of natural endowments and recycling, zero-emission transportation, clean energy, environmental protection and adaption to climate change.

The biggest change from the original 2015 edition of the catalogue is that green bonds can no longer be issued to finance “clean coal” or other fossil-fuel-related projects. The new criteria, much more closely aligned with internationally accepted green bond norms, is hoped to raise the interest of international investors. According to the PBoC, the outstanding domestic balance of green bonds last September was over 1 trillion yuan (about $160 billion), nearly 25 % higher than a year earlier. Over $63 billion in new green bonds were issued in the first nine months of 2021, already exceeding the total amount of issues for the previous record year of 2019.

To further grow the share of green financing in the financial sector, the PBoC last November launched a carbon emissions reduction facility. Under the central bank’s new policy instrument, banks are eligible for low-interest financing from the PBoC if they finance corporate emissions reduction projects. The PBoC reports that by the end of last year it has issued funds worth of 85.5 billion yuan (just over $13 billion) via the facility.

China has also boosted its cooperation with the EU on green financing. China is a founding member of the International Platform on Sustainable Finance (IPSF), launched by the EU in 2019. The IPSF seeks to establish globally applicable criteria for green financing in order to attract capital for investment in projects that are environmentally sustainable. Founding IPSF members also include Argentina, Canada, Chile, India, Kenya and Morocco. The membership has since grown to include Hong Kong, Indonesia, Japan, Malaysia, New Zealand, Norway, Senegal, Singapore, Switzerland and the UK. The member countries represent about half the global population and account for about 55 % of global greenhouse emissions.

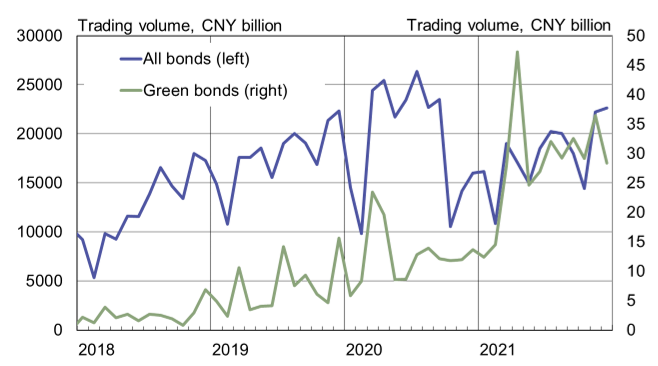

Trading in Chinese green bonds picked up steam last year, even if trading volumes overall remained quite modest

Sources: CFETS, Macrobond and BOFIT.