BOFIT Weekly Review 45/2021

Russian bank lending remains strong

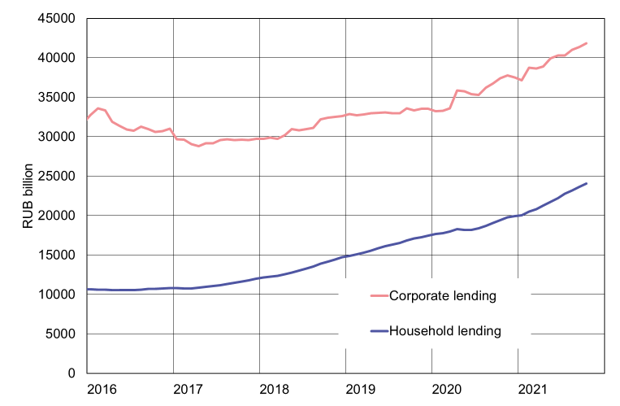

The stock of bank corporate lending, which increased by about 10 % last year, has seen robust growth for all of this year. Helped especially by high growth in borrowing for oil & gas sector infrastructure projects, the credit stock grew briskly in September. As of end-September, the stock of corporate loans was up by 11 % y-o-y. About half of corporate loans have maturities over three years. Slightly over a fifth of corporate loans in recent year have had maturities of less than a year, but during the pandemic the short-term credit component of the credit stock climbed to over 25 %.

The pace of bank lending to households has picked up considerably this year, particularly due to strong growth in consumer credit. Despite a tightening of capital requirements for consumer loans in July, the growth in the credit stock has shown few signs of abating. The stock of consumer credit was up by 21 % y-o-y. Demand for housing loans has also remained strong this year, even if the interest subsidies for new apartment buyers were reduced slightly in June. The share of non-performing loans in the total credit stock also declined slightly in the first nine months of this year. Most households have fixed-rate loans, so changes in interest rates have little impact on their borrowing costs.

Growth in bank lending to households has been strong in recent years

Sources: Central Bank of Russia and BOFIT.