BOFIT Weekly Review 41/2021

Russia’s government budget expected to show surpluses as efforts are ahead to slow spending growth

At the end of September, the federal budget and the budgets for the state’s three social funds were submitted by the government to the lower-house Duma for approval. At the same time, the finance ministry released its comprehensive revenue and spending estimates for 2021−2024, which cover the entire consolidated budget, i.e. federal and social fund budgets, as well as regional and municipal budgets.

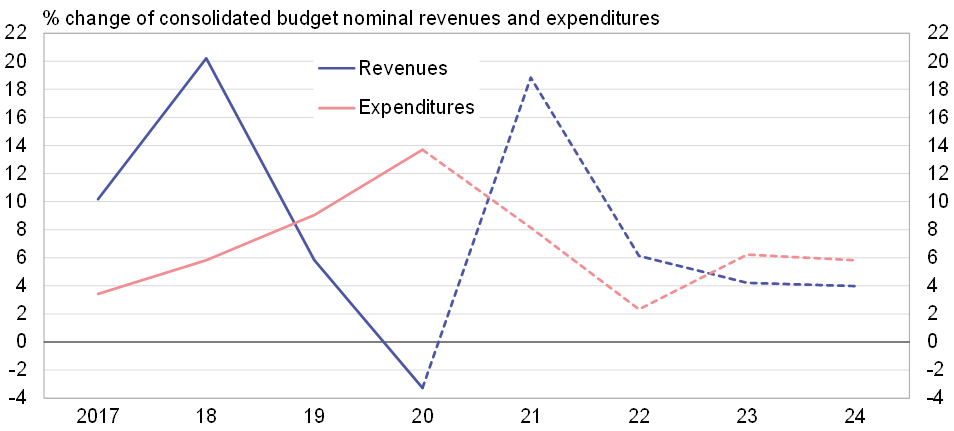

Nearly 20 % growth in nominal public sector revenues is expected this year. High oil & gas prices should boost revenues from oil & gas taxes by over 60 % from last year’s covid dip. Other budget revenues are expected to increase by over 10 %. Spending growth will slow this year from last year’s stimulus, but will still reach about 8 %. The budget balance turned deeply into red last year (4 % of GDP), but this year the deficit is expected to shrink to just 0.5 % of GDP.

Under the economic development ministry’s forecast for 2022−2024, GDP growth is expected to remain at 3 % p.a. While the export price of Urals-grade crude is assumed to decline gradually from this year’s $66 a barrel to $56 in 2024, crude oil production and exports are expected to rebound strongly in 2022 with the fading out of production ceilings under the OPEC+ agreement. With that, revenues from oil & gas taxes should increase appreciably still next year. Growth of other revenue streams in the consolidated budget such as VAT revenue is expected to slow already next year to around 5 % a year, i.e. considerably lower growth than in the years preceding the recession of 2020.

The target of lowering nominal growth of government sector spending to around 4.5 % a year in the next few years, only slightly faster than forecast inflation, is maintained like in the policy adopted last year. The level of spending will be higher than scheduled earlier due to rapid spending growth last year and this year. Spending relative to GDP will fall from 40 % last year to around 35 % a year during 2022−2024. Increased revenue estimates for the consolidated budget yield small surpluses.

The estimates see education spending increasing rather steadily at 6−7 % p.a. in 2022−2024. After a long period of slow spending growth, spending on domestic security and law enforcement next year will increase sharply and then match inflation in subsequent years. Defence spending will increase slowly until 2024, when a notable increase is planned. After a rapid rise in 2019−2020, growth in spending on various sectors of the economy is set to be very slow. Spending on healthcare has grown rapidly for several years but growth will now be slower than inflation. Such pace is also foreseen for spending on social supports (including pensions). The current plans are to freeze nominal growth in spending on public administration following high growth in 2020 and 2021.

General increases in wages of public servants are expected to only keep pace with inflation, with the exception of certain groups in healthcare and education who will get wage hikes in line with wage developments nationally. Pensions for those pensioners who do not work will be raised in line with a 2018 law so that the increases outpace inflation slightly.

Even with a slight surplus, the government continues to borrow from the domestic market as the government’s fiscal rule calls for setting aside part of oil & gas tax revenues and transferring them to the National Welfare Fund (NWF). Government debt at the end of 2024 should be just over 20 % of GDP, while the value of NWF total assets should rise to 15 % of GDP. In the coming years, NWF assets will be lent to finance domestic infrastructure projects.

Government budget revenues are on the rise while growth of expenditures is slowing to levels roughly on par with inflation

Sources: Russian Ministry of Finance and BOFIT.