BOFIT Weekly Review 41/2021

Russian export earnings near all-time highs; capital outflows increase

Preliminary balance-of-payments figures from the Central Bank of Russia show that the value of Russia’s exports of goods and services in the third quarter hit $148 billion, a 65 % y-o-y increase. Export earnings were close to the peak years of 2011–2013, when crude oil prices soared to historical highs, averaging $110 a barrel. In July-September, in contrast, the average oil price was just $70 a barrel. Exports of goods other than oil & gas indeed had a substantial contribution to total export growth. The value of these exports broke an all-time record in the third quarter supported by the buoying demand and rapidly rising prices of several raw materials in the global markets.

In the third quarter, the value of Russian goods and services imports was $96 billion, an increase of 30 % y-o-y. The rise in imports slowed sharply from previous months, while imports exceeded pre-covid levels. Goods imports have driven the recovery in imports. Services imports have only slightly recovered since the Covid Recession.

The rapid growth in exports also lifted Russia’s third-quarter current account surplus to a record $41 billion. The total current account surplus for the last four quarters corresponds to about 5 % of GDP.

The increase in export earnings has also been reflected in Russia’s foreign currency and gold reserves, the value of which stands at a historical high. The value of Russia’s currency reserves was also boosted by IMF special drawing rights (SDRs) that were distributed in August to the central banks of IMF member countries to help with their covid recoveries. The value of Russia’s share in this SDR allocation was $17.5 billion. As of end-September, the value of Russia’s foreign currency and gold reserves stood at $614 billion (about 40 % of GDP).

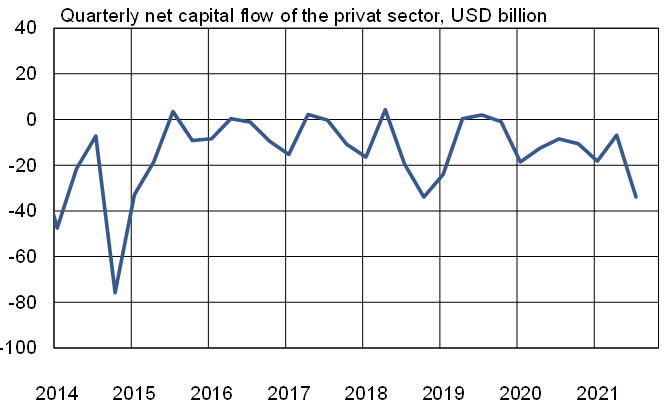

Capital outflows from Russia increased rapidly in July-September. The net outflow of private sector capital amounted to $34 billion, the largest net outflow in three years. The outflow was mainly driven by foreign investments and lending of non-bank corporates. The total private sector net capital outflows for the last four quarters corresponds to about 4 % of GDP.

Private sector capital outflows from Russia picked up in third quarter of this year

Sources: Central Bank of Russia, Macrobond and BOFIT.