BOFIT Weekly Review 38/2021

China makes targeted relaxes to capital outflows

The Bond Connect programme that allows foreign institutional investors to invest via Hong Kong in mainland China interbank market has been in place since summer 2017 (BOFIT Weekly 27/2017). The long-awaited possibility of investing in the other direction, i.e. from mainland China to Hong Kong, became reality today (Sept. 24). In recent years, restrictions on capital movements have begun to be lifted through a range of targeted programmes. While pressure to move money out of China doesn’t seem particularly great at the moment, the situation could change, and officials still have the means to be able to move swiftly to stem capital outflows.

In the programme’s initial phase, trading in Hong Kong for mainland investors is more restricted than the other way around. The now opened Bond Connect southbound leg allows trading for 41 financial institutions and Chinese institutional investors that have been cleared for the QDII and RQDII programmes. The net cross-border outflow from bond trading under the programme is regulated as to the daily quota (20 billion yuan) and the annual quota (500 billion yuan). Chinese investors can make their bond investments in yuan or foreign currency. When a forex bond matures, however, the assets must be repatriated and converted to yuan. There are no corresponding quotas for foreign investors trading on the mainland bond market (i.e. northbound leg). The northbound programme currently has 689 approved foreign institutional investors and the average daily trading volume has risen this year to around 26 billion yuan, up from just 1.5 billion yuan in 2017.

Capital flows between mainland China and Hong Kong are further encouraged with opening of the Greater Bay Area investment programme that aims to increase financial links in the Pearl Bay Delta. The trial phase of “Wealth Management Connect” opens on October 10. The programme allows residents of nine cities in Guangdong province to invest in certain wealth management products in Hong Kong and Macao. Residents of Hong Kong and Macao, in turn, can invest in select investment products of mainland China banks. Quite expectedly, the programme is subject to strict quotas that limit total annual investment flows to 150 billion yuan in either direction and one million yuan per investor (not to mention other demands such as demonstrating sufficiently long investment experience and adequate resources).

Qualified Chinese institutional investors are permitted to invest abroad under the QDII and RQDII programmes. Over the past twelve months, the number of participants in the QDII programme has grown from 152 to 173, while the total available investment quota has risen from $104 billion to $150 billion. The elimination of quotas for the qualified and renminbi qualified foreign institutional investor programmes in mainland China and the combining of the programmes was announced in 2019 and entered into force last year (BOFIT Weekly 39/3019).

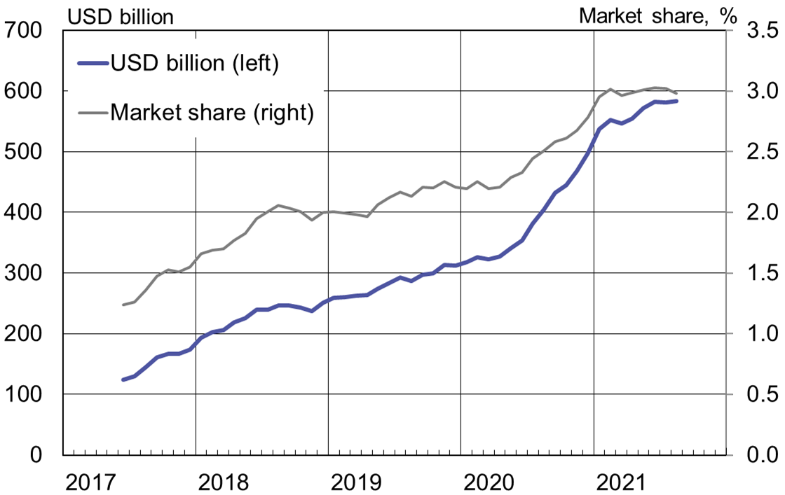

While foreign ownership in China’s bond markets has increased rapidly, it still only accounts for about 3 % of the total market capitalization. Demand for Chinese bonds has also been boosted by their inclusion in a number of major international indices. In July and August, however, the pace of new investment slowed to a trickle. Nearly a third of foreign investment in mainland China’s bond markets are made through the Bond Connect programme.

Foreign investors continue to increase their holdings of Chinese bonds.

Sources: CEIC, Bond Connect Company Ltd. and BOFIT.