BOFIT Weekly Review 36/2021

Plans announced for mainland China’s third stock exchange in Beijing

In his address to the International Fair for Trade in Services, president Xi Jinping revealed plans to open a new stock exchange in Beijing. Soon after the announcement, the China Securities Regulatory Commission (CSRC) issued a press release (in Chinese). The new stock exchange is intended to help small, innovative firms with growth potential that otherwise have limited access to financing. No timetable on the stock exchange’s launch has been released.

The starting foundation of the new Beijing stock exchange is China’s national over-the-counter stock exchange (National Equities Exchange and Quotations, NEEQ). NEEQ was founded in 2013 with a view to improving access to market financing for small and medium-sized enterprises. NEEQ’s shareholders are several Chinese stock and commodities exchanges, including Shanghai and Shenzhen stock exchanges. As of August, the NEEQ list contained about 7,300 firms, an impressive number compared to the Shanghai, Shenzhen and Hong Kong stock exchanges. However, the listed firms are considerably smaller, having a combined market capitalisation of just $360 billion (e.g. the market cap of the Shanghai bourse is nearly 20 times larger). Only professional investors can buy and sell shares of NEEQ-listed firms.

Since July last year, firms listed on the NEEQ have been divided into three groups: basic list, innovation list and select list. Initially, just 32 firms qualified for the select list, i.e. firms that meet the strictest listing demands. That number has since risen to 66. Companies on the select list will be eligible for immediate listing on the Beijing stock exchange, that also would be administered by the NEEQ. The total market capitalisation of select firms in August was 170 billion yuan ($26 billion). New firms are expected to emerge on the Beijing stock exchange via the NEEQ basic and innovation lists with the Beijing stock exchange acting as an incubator for SME firms. Once a firm grows large enough, it could apply for listing on either of China’s other two stock exchanges (Shanghai or Shenzhen).

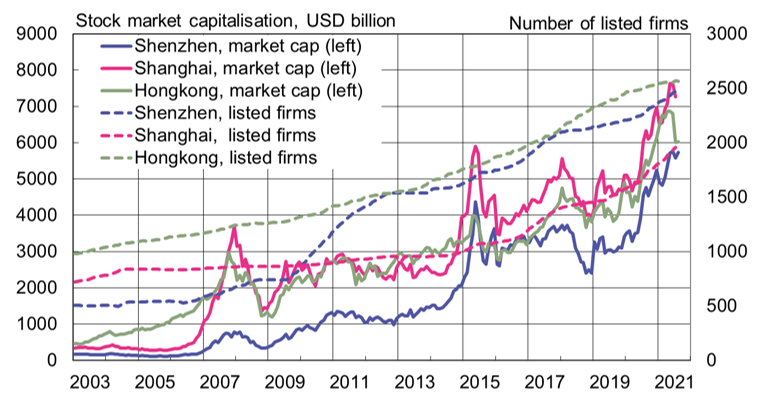

The Shanghai stock exchange is Asia’s largest and the world’s third largest bourse after the New York stock exchange and the NASDAQ stock exchange. In July, the market capitalisation of companies on the Shanghai exchange was nearly $7.3 trillion. The Shenzhen stock exchange is smaller than the Shanghai exchange, but its total market cap is still $5.6 trillion making it the world’s seventh largest bourse. Both exchanges have their own tech company lists. The ChiNext list, which brings together high-growth tech firms, was rolled out on the Shenzhen stock exchange in late 2009. The Shanghai stock exchange’s Star Market list of tech firms was established a decade later. The Star Market was created to ease listing requirements and reduce trading restrictions (BOFIT Weekly 30/2019).

The market capitalisation of the Shanghai stock exchange has risen faster than that of the Shenzhen or Hong Kong exchanges

Sources: World Federation of Exchanges, Macrobond and BOFIT.