BOFIT Weekly Review 30/2021

China’s plunge into indebtedness has slowed in recent months

The People’s Bank of China reports that on-year growth in aggregate financing to the real economy (AFRE, consisting of bank loans, debt securities, shadow banking and other forms of financing) slowed in June to below 11 %. AFRE growth, driven by the government’s pandemic stimulus response, reached nearly 14 % last year. In the financial item category, growth in bank lending (64 % of AFRE) has slowed only slightly, while the on-year growth in the stock of corporate debt securities (10 % of AFRE) has fell from over 20 % last summer to under 7 %. Growth in the stock of government-sector bond issues (16 % of AFRE) also slowed substantially.

Financing provided by the shadow banking sector has continued to shrink this year, and was down by 10 % y-o-y in June. Due to more heavy-handed regulation of China’s credit markets, the shadow banking sector has shrunk for three consecutive years. The share of financing provided by the shadow banking sector has fallen from 14 % of AFRE in 2017 to below 7 % in June.

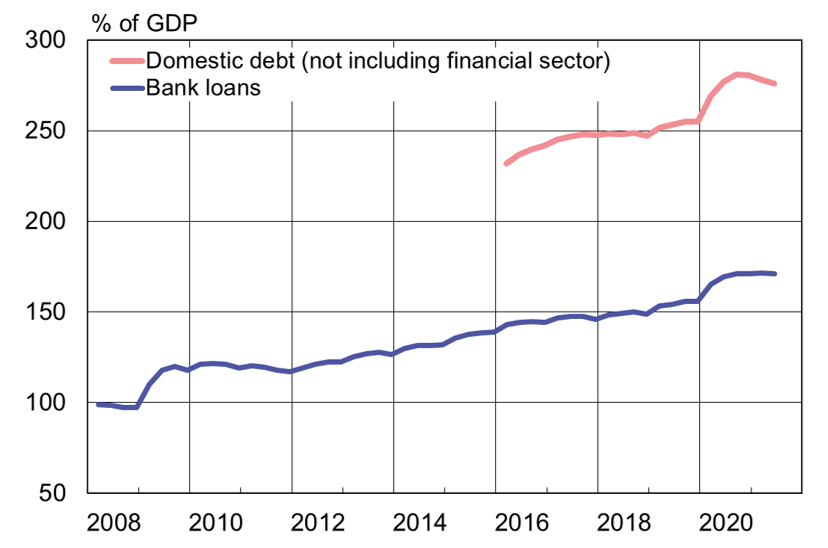

China’s domestic debt-to-GDP ratio has fallen slightly with the slowing rise in indebtedness and rapid economic expansion. At the end of June, domestic debt corresponded to 276 % of GDP, down from 280 % of GDP at the end of last year. According to the State Administration of Foreign Exchange (SAFE), China’s foreign debt at the end of March was equal to 15.5 % of GDP, of which 48 % was dollar-denominated debt and 43 % in yuan-denominated debt.

China’s domestic debt-to-GDP ratio has diminished slightly this year

Sources: People’s Bank of China, China National Bureau of Statistics, CEIC and BOFIT.