BOFIT Weekly Review 27/2021

Russian government works on changes in taxes next year and price controls

As part of preparing Russia’s 2022−2024 federal budget and assessment of the prospects of the entire government sector (also including budgets of regions, municipalities and state social funds), the government is considering a range of tax increases. These changes are aimed at increasing government budget revenues during the 2022−2024 period by the equivalent of nearly 0.4 % of GDP. The extra income divides rather evenly into four parts. The first contribution would come from higher production taxes on metals. Second, taxation on oil sector profits would be expanded. Third, improved excise tax revenues would be achieved through higher rates and better tax collection (this mainly concerns alcohol and sugary beverages). Finally, incomes of high-earners and wealthy private individuals would see some higher taxes. At the same time, large restaurant chains will become exempt from value-added taxes and their social taxes based on wages will be halved from 30 % to 15 %. More comprehensive information on changes in next year’s taxation has yet to be published.

The budget preparation each year involves consideration of tax increases and decreases. For example, the finance ministry last autumn estimated that the tax increases decided would raise government budget tax revenues in 2021−2023 by about 0.4 % of GDP. The estimate assumed that part of tax breaks on oil fields would be rescinded as planned and taxation on Russian capital income abroad would rise as a result of renewed bilateral tax treaties e.g. with countries considered tax havens. The ministry estimated the budget would lose revenues equal to around 0.4 % of GDP from cutting the 30 % general rate for social taxes by employers in half for small and medium-sized firms.

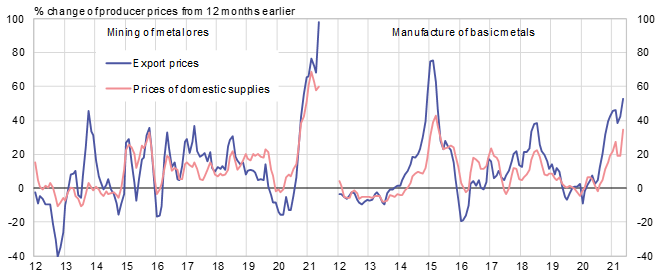

The increases of production taxes planned now on metals would follow up on a fresh decision to widen metal export duties from the beginning of August until the end of this year. This has two aspects. As metal prices have risen dramatically on global and thereby also on domestic markets, the increases are to limit exports and thus take pressure off domestic prices. At the same time, there is a desire to tax the profits now being raked in by metal companies from high prices.

Raising taxes on metal production and exports has rather long (and quite justifiably) been suspected. In 2018, a list prepared in the Kremlin was leaked to the public. The list named a number of metal producers, as well as companies involved in production of petrochemicals and other chemicals, which, due to high export prices, had enjoyed profits that were deemed excessive. Had those profits been taxed as planned in the list, the budget would have received extra revenues equivalent to over 0.5 % of GDP. Due to noises from Russia’s industries, the list plan did not proceed. Permanent changes are now scheduled in taxation of metals, which could become similar to the tax system in the oil & gas sectors. For about the past two decades, oil & gas have been taxed mainly through production taxes and export tariffs based on predetermined formulas. No separate decisions are required as tax and duty rates adjust automatically (and progressively) to changes in world market prices.

Rising prices for specific products such as grain have also earlier been dealt through imposition of temporary export quotas and export duties. In late 2020, the government decided to increase export duties on grains and certain other agricultural products, along with imposing export quotas, to deal with surging impacts of global prices on domestic prices. Adjustments continue. Recently, the export duties on major grains have been transformed into duties floating with prices. The export duty on sunflower seeds just recently saw a steep hike and will remain in place until the end of August 2022. Export tariffs on soybeans, while freshly lowered, will also remain in place for longer than earlier decided.

The government is considering a broader permanent mechanism to moderate the impact of shifting global market prices on domestic prices. The planned mechanism is reported to cover prices of metals and other goods, especially fertilisers and foodstuffs such as meat and milk.

Russia’s export prices for metals and domestic producer prices have soared

Sources: Rosstat and BOFIT.