BOFIT Weekly Review 27/2021

Despite this year’s sharp rise in oil prices, ruble sees only marginal appreciation

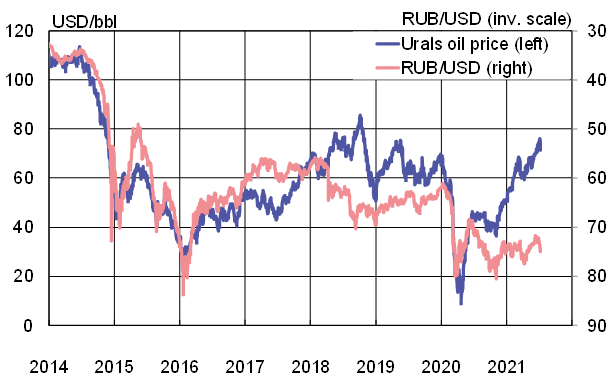

The price of Urals-grade crude oil hit $74 a barrel at the end of June, a 45 % increase from the start of the year. Oil prices have not been this high since 2018. The soaring prices of crude oil and other commodities have largely been driven by the recovery of the global economy from the depths of last year’s Covid recession. OPEC estimates that demand for crude oil increased by roughly 6 % y-o-y in January-June, but was still 5 % below 2019 pre-covid levels. Oil prices have also been supported by the production-ceiling agreement among the OPEC+ countries, even with the ceilings raised gradually to accommodate recovering demand. The OPEC+ group was set at the start of this month to revisit production ceilings for the remainder of 2021, but the meeting did not take place due to disagreements between Saudi Arabia and the United Arab Emirates. Oil prices have continued to climb in July as the anticipated OPEC+ production increases for coming months have not been confirmed.

Despite the solid rebound in oil prices, the ruble’s end-June exchange rate was up by just 2 % year-to-date against the US dollar and 6 % against the euro. According to the Central Bank of Russia, the country had a substantial current account surplus for the first five months of this year, which largely reflects higher oil prices. Capital, mainly from the corporate sector, continues to flow out of Russia, however. The ruble appreciation has also been held back by the scheduled CBR currency-buying under the government’s fiscal rule that was restarted this year.

Despite the rebound in the price of Urals crude, the ruble has shown only modest gains this year

Sources: Reuters and BOFIT.