BOFIT Weekly Review 07/2021

Russian government spending in stimulus mode last year

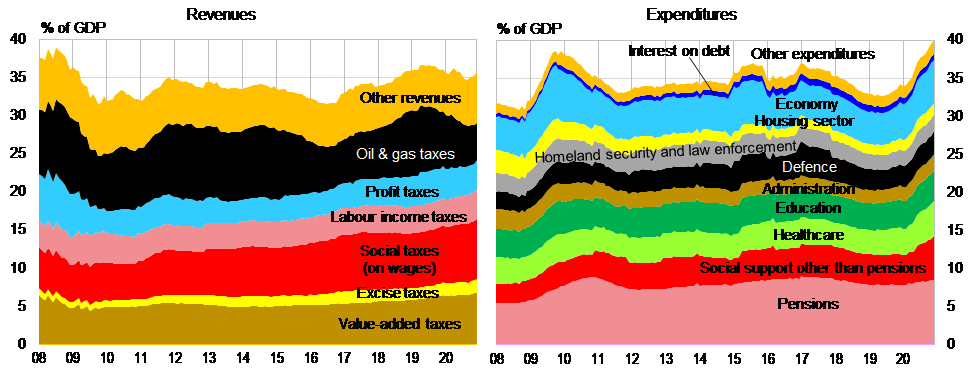

Consolidated budget revenues declined last year by only about 3 % in nominal terms (the consolidated budget comprises federal, regional and municipal budgets, plus the budgets of the state social funds). The drop in revenues was mitigated by last spring’s operation to transfer the main ownership stake in giant state bank Sberbank from the CBR to the government, and then return almost all of the resulting CBR surplus on the sale to the state budget. Without the Sberbank operation, government revenues would have fallen by about 6 %. Revenue performance was hit hardest by a fall of oil & gas tax revenues by one third. Other revenue streams increased slightly even without the one-time budget injection from the Sberbank operation. Budget spending was increased by about 14 % to fight the covid crisis and economic downturn. The amount is significant also in real terms as Russia’s inflation rate was unusually low around 3.5 % for all of 2020, which meant that there was relatively little erosion of the government’s purchasing power.

The ratio of revenues to GDP was about 36 %, of which 1 percentage point came from the Sberbank operation. Support and recovery measures boosted the government’s expenditure-to-GDP ratio to nearly 40 %, a record level not seen since the spending in recession years of 1998 and 2009. The consolidated budget went from a notable surplus to a deficit of slightly over 4 % of GDP. The deficit was financed largely through borrowing from domestic banks. The government’s total debt at the end of 2020 was about 18 % of GDP. The liquid assets of the National Welfare Fund, which is the government’s reserve fund, corresponded to about 8 % of GDP.

The budget situation began to improve in the final months of 2020. Consolidated budget revenues exceeded those of a year earlier by several percent. Non-oil revenues in the fourth quarter of 2020 were up by well over one tenth y-o-y, which to some extent may have reflected the ending of forbearance periods on some tax payments. Even if contracting by more than one quarter y-o-y, revenues from oil & gas taxes declined less than in previous quarters. Spending stimulus fell slightly from the summer peak, but spending was still up by one tenth from a year earlier.

A downward effect on non-oil budget revenues came from a fall in revenues from corporate profit taxes. Other revenue streams including labour income taxes, social contributions by employers in conjunction with wage payments, as well as excise taxes and value-added taxes, increased or stayed unchanged from the previous year. Spending rose across the board for all government functions, largely due to supports and measures to deal with covid-19. Spending on social support other than pensions increased by about 40 % with a 2.5-fold increase in family support spending. Healthcare spending rose by 30 % and spending on various sectors of the economy such as telecommunications, transportation and roads grew as a whole by 17 %. Spending on public administration also increased by nearly 10 %. Spending on defence, homeland security and law enforcement, as well as education and pensions, grew by 5−7 %.

The role of oil & gas tax revenues in Russia’s consolidated budget has diminished. Budget spending last year hit a record level.

Sources: Russian Ministry of Finance and BOFIT.