BOFIT Weekly Review 49/2020

Russian government support has helped move fixed investment towards recovery, outlook remains unsure

After shrinking by 7.5 % y-o-y in the second quarter, real fixed investment contracted by over 4 % y-o-y in the third quarter. Fixed investment has turned much faster to the recovery path than it did during the recessions of 2009 and 2015 (recovery took over a year in both cases).

Fixed investment was down by about 4 % y-o-y for the first nine months of this year. Rosstat only gathers within-year data for large and mid-sized firms as well as government sector investment, which together represent about three-quarters of total fixed investment, and estimates the rest. Fixed investment for the monitored category declined by less than 2 % y-o-y in January-September. Thus, Rosstat estimates that the covid pandemic and depression of the economy pressed down other fixed investment by about one tenth.

The overall decline of fixed investment of large and mid-sized was led especially by a sharp drop of investment in oil & gas pipelines as well as by service providers for oil & gas production. The downhill slide of manufacturing investment (not including production of petroleum products) became slightly steeper in the third quarter. Fixed investment in Russia’s two large and capital-intensive branches of manufacturing –petroleum products and metals – has instead increased substantially. A larger reduction in total fixed investment, however, has been offset by a strong rise in investment in health care, public administration and also the education sector.

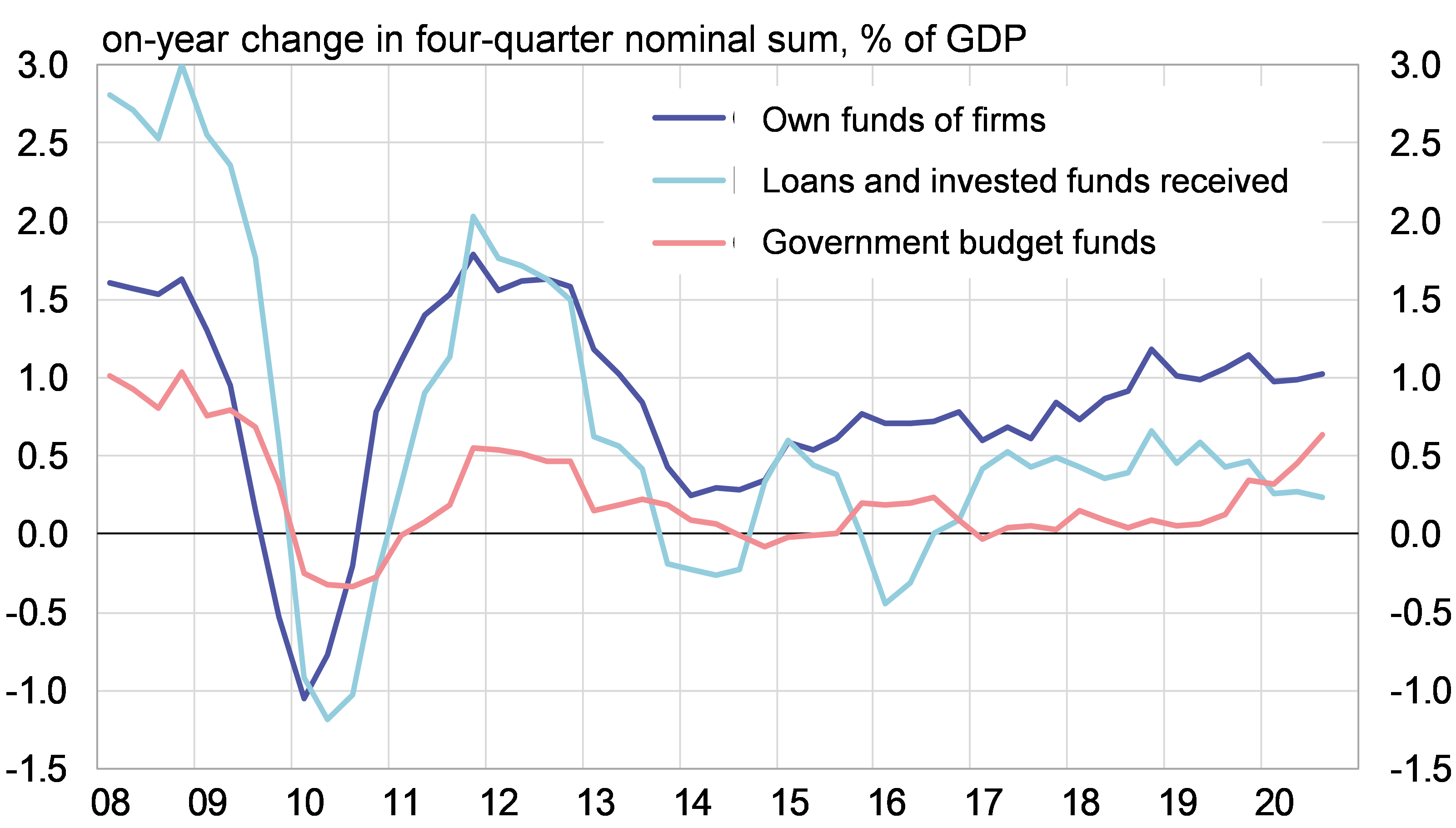

Increased investment in government budget sectors is reflected in fixed investment financing. The government budget sector administrative levels, mainly federal and regional governments, have increased investment financing most strongly in a decade. Moreover, the out-of-pocket investment of large and mid-sized firms has remained stable and continued to be the largest funding source. This has been helped to some extent by government support measures, including corporate subsidies paid out from the government budgets. Overall, corporate funds at banks have increased further this year.

Investment outlook is uncertain for the coming months. Rosstat monitoring finds that industrial capacity use is at its lowest level in ten years. The Central Bank of Russia notes that investment outlook might be weak as so far investors have had limited possibilities t0 change their ongoing investment programmes.

The government has played an increasing role in financing fixed investment during this year’s recession (large and mid-sized firms, as well as government fixed investment)

Sources: Rosstat and BOFIT.