BOFIT Weekly Review 47/2020

Reduced revenues and higher spending caused Russia’s government budget sector deficit to deepen

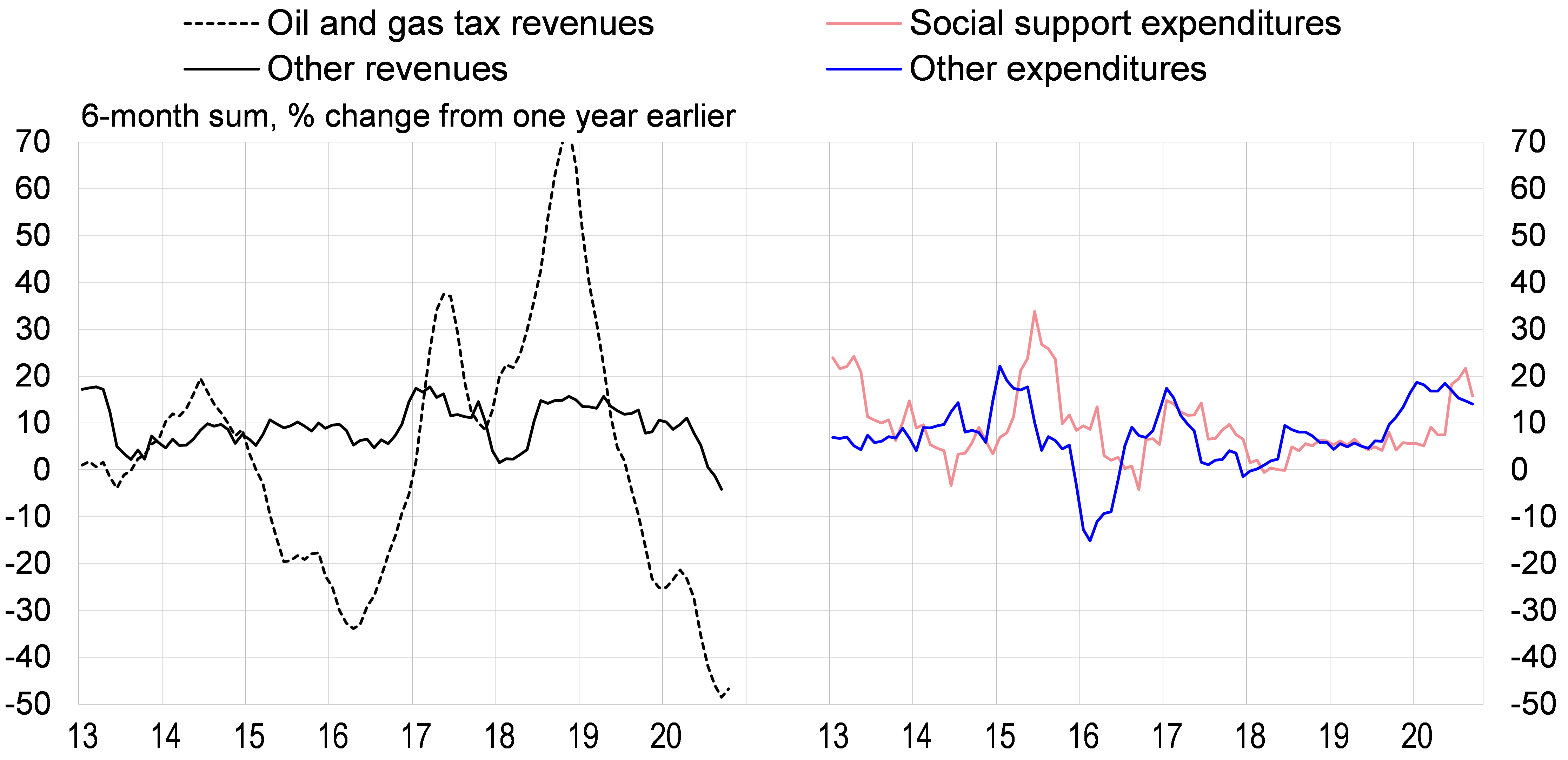

Revenues to the consolidated budget (federal, regional and municipal budgets, plus state social fund budgets) were down by 14 % y-o-y in the third quarter. The on-year drop in revenues in the third quarter was less severe than in the second quarter when revenues fell by 23 % − that is without the one-time budget windfall in April involving the payment by the central bank from its extra surplus created by the transfer of Sberbank’s ownership from the central bank to the government.

The increase in consolidated budget expenditures that already began last year has continued throughout this year. Spending was up by nearly 12 % y-o-y in the third quarter, even if the on-year growth figure was smaller than in the previous two quarters (17–18 %). The spending growth also in the third quarter has provided a factor limiting the economy’s contraction as inflation has remained relatively slow.

The opposing movements in revenues and expenditures have increased the consolidated budget deficit. The past 12-month deficit in September corresponded to about 3.5 % of GDP, putting the state on track to post the deficit estimated for this year at about 4.5 % (not counting the Sberbank payment the 12-month deficit would have been about 4.5 % of GDP in September). The government last spring was covering its burgeoning budget deficit by a combination of using liquid funds on its accounts and borrowing. In late summer and autumn, however, the government has relied increasingly on borrowing.

The consolidated budget’s collapse in oil & gas tax revenues moderated in the third quarter, but these revenues were still down by 37 % y-o-y. Other budget revenues declined by more than 8 % y-o-y, which was also less severe than in the second quarter (down by 14 % y-o-y if April’s Sberbank payment is not included). On the other hand, the dwindling of budget revenues was still that large as taxes are paid to the budget later than taxable incomes accrue to taxpayers. In addition, the government’s tax rebates and payment extensions granted last spring are in force. Revenues from corporate profit taxes, in particular, were still quite deep down in the third quarter while value-added tax revenues declined further (VAT, the largest budget revenue stream, accounts for a fifth of total budget revenues). The bright spot in this otherwise dismal budget revenue picture was a slight improvement on the wage front. The mild decline in revenues from employers’ wages-based social taxes ceased and revenues from labour income taxes recovered.

Growth in budget spending on social supports slowed in the third quarter, but was still 13 % y-o-y (18 % growth in January-June). The pace of other spending growth slowed from 17 % in the first half to 10 % in the third quarter. Their growth also slowed in real terms as the pace of inflation stayed rather unchanged. Healthcare has clearly led the fast rise in budget spending throughout this year due to covid-19 crisis. Healthcare spending was up about 33 % y-o-y in the first nine months. Budget spending on subsidies and fixed investments in different branches of the economy continued to rise briskly in the third quarter, and was up by over 20 % y-o-y in the January-September period. In addition, spending on public administration increased by 14 % y-o-y in January-September, while spending growth on domestic security and order exceeded 10 %. Education spending grew by under 7 % in the period, while defence spending rose by 4 %. Defence spending declined in the third quarter after a peak last spring.

Russia’s government sector revenues have dropped precipitously while spending has increased rapidly

Sources: Russian Ministry of Finance and BOFIT.