BOFIT Weekly Review 35/2020

Subsidy programmes and rate cuts support bank lending in Russia

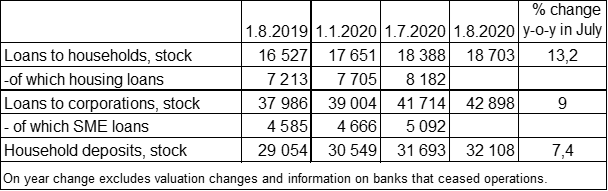

The corporate loan stock experienced robust growth in the first quarter of the year as companies prepared (for example, by securing lines of credit) for impending coronavirus restrictions and lockdown. In the second quarter, the growth of the loan stock slowed, but in July the stock of corporate loans increased by 1.6 % m-o-m. The growth in lending mostly reflected credit granted to a few large companies and funds channelled through various state support schemes. As of end-July, corporate loans granted by credit institutions amounted to 42.9 trillion rubles, with annual growth in the loan stock accelerating to 9 % y-o-y in July. Lending to the small and medium-sized enterprises (SMEs), boosted by various state support schemes, grew slightly faster. However, loans to SMEs only account for around 12 % of the corporate loan stock. Interest rates on ruble-denominated loans have fallen significantly this year. The average interest rate on loans for less than a year was 6.9 % in June, almost two percentage points lower than a year earlier.

At the end of July, the stock of household loans amounted to 18.7 trillion rubles, an increase of 13 % y-o-y. Growth in the loan stock slowed from last year, and increasingly relied on strong growth in housing loans. About 45 % (8.2 trillion rubles) of all household loans at the end of June were housing loans.

The decline in interest rates could also be seen in deposit rates. In June, the rate paid on household deposits of less than a year fell below 4 % p.a., which is below the CBR’s key rate. Lower interest rates have spurred interest in other investments. In April-June, nearly a million new small investors entered the securities markets. The value of assets held in investment accounts of private individuals grew by 14 % y-o-y, clearly outperforming bank deposits.

Loans to households and corporates, as well as bank deposits, increased over the past year

Sources: CBR and BOFIT.