BOFIT Weekly Review 35/2020

Russian government budget revenues decline precipitously, spending soars

Revenue streams to the consolidated budget, an aggregate of federal, regional and local budgets plus state social funds, decreased by 13 % y-o-y in the second quarter and by about 4 % in the first half of the year. The decrease was mitigated by a large one-time payment from Central Bank of Russia’s additional surplus to the federal budget in April, which resulted from the sale of the central bank’s majority stake in Sberbank to the government (BOFIT Weekly 17/2020). Without the CBR payment, consolidated budget revenues were down by 23 % y-o-y in the second quarter and 9 % in the first half.

Consolidated budget spending has increased. Spending in both the first and second quarters was up by about 17 % y-o-y. Budget spending has provided stimulus to the economy as it has increased significantly even in real terms. The effectiveness of the stimulus has been helped considerably by fairly moderate rises in consumer prices and fixed investment prices, as well as a decline in producer prices of industrial goods supplied to the domestic markets (for more on developments in Russian budget expenditures and revenues in real terms see our just released BOFIT Policy Brief 10/2020).

After two years of surplus, the reduction in revenues and higher spending this year have turned the consolidated budget to deficit. The 12-month deficit for the period ending in June corresponded to 1.3 % of GDP (without the CBR’s one-time payment, the deficit would have exceeded 2 % of GDP).

Nearly all revenue categories of the consolidated budget have decreased substantially this year. Smaller revenues from oil & gas taxes lowered their share of total budget revenues to 15 % in the first half. Other budget revenues in the first half of the year were up 5 %, while remaining unchanged on-year in the second quarter. Again, without the CBR’s one-time transfer, revenues would have fallen in the second quarter by 13 % y-o-y. Revenues from corporate taxes fell sharply in the second quarter (down 30 %), creating a large hole in the budget. The decline in budget revenues from property taxes and special taxes on entrepreneurs, as well as the drying up of dividends from state-owned enterprises also had notable impacts. Revenues from labour income taxes fell much less (down just 10 %). Value-added-tax revenues and mandatory social contributions based on wage earnings were only down by 5 %. The reductions in some revenue streams were not due only to the economy’s dive in the second quarter but also the government’s spring decisions to grant tax reductions and extensions on tax payments.

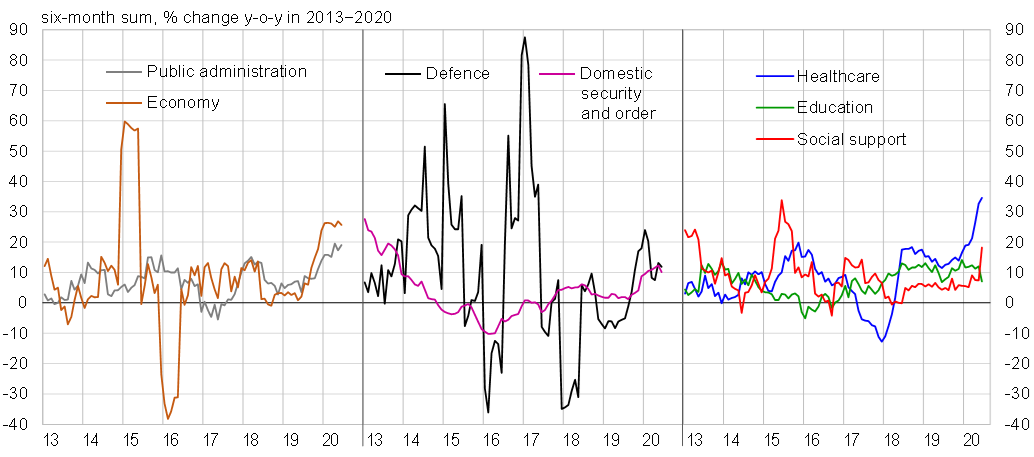

Increased budget spending has focused especially on healthcare due partly to the coronavirus pandemic (up 35 % y-o-y in the first half) and the economy (up 26 %), mainly transportation and roads. The spending boosts for health and the economy were reflected in goods & services, corporate subsidies and fixed investment with unusually rapid increases of expenditures. In addition, the budget’s biggest spending category by far – spending on social support – grew briskly, mostly on near-doubling of support to families. Amidst the covid-19 crisis, spending on public administration as well as domestic security and order also increased notably faster than in previous years. The rise in defence spending accelerated in the second quarter.

Main spending categories of the Russian government budget sector (consolidated budget) show considerable increases this year

Sources: Russian Ministry of Finance and BOFIT.