BOFIT Weekly Review 30/2020

China’s central and local governments issue special purpose bonds to support economy

Most of China’s fiscal stimulus policy measures in dealing with the coronavirus pandemic have involved increasing financing of public projects through the issuance of “special purpose bonds.”

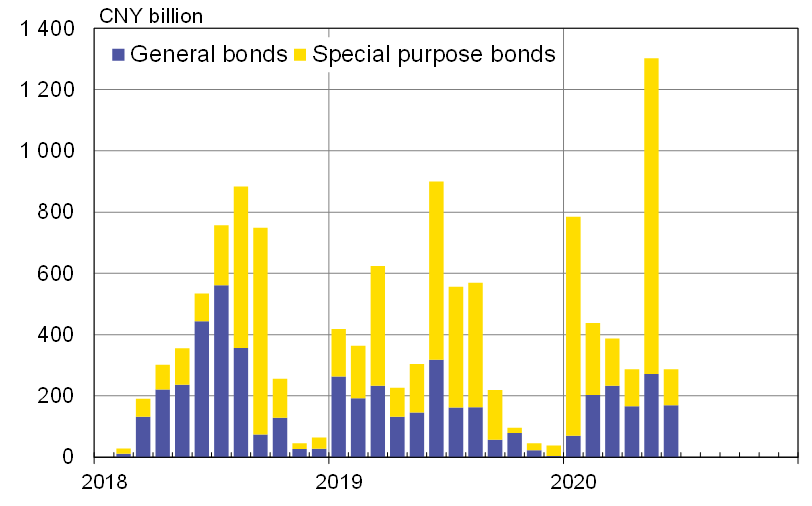

In the first six months of this year, local governments issued bonds worth a total of 3.49 trillion yuan (500 billion dollars), of which some 2.37 trillion yuan were special purpose bonds. The finance ministry reports that the average maturity on local government bond issues this year has been 15 years with an average yield of 3.33 %. Local governments have a bond quota this year of 4.73 trillion yuan, including 3.75 trillion yuan in special purpose bonds.

Special purpose bonds provide an off-budget source of financing for local government projects. Typically, such bonds were used to finance infrastructure projects to be paid off with cash flow from the project. The range of reasons for issuing special purpose bonds has been widened recently to include for example supporting consumption demand. At the beginning of July, the government announced that part the money raised from issuing special purpose bonds could be used to recapitalise small and mid-sized banks. Local governments replenish the capital of local banks by purchasing their convertible bonds.

The government has so far issued 1 trillion yuan in special purpose bonds to finance its coronavirus pandemic efforts. As of mid-July a total of 240 billion yuan in bonds had been issued. The remaining part of the quota must be issued by the end of July. Special purpose bonds are currently available with maturities of 5, 7 and 10 years. The average yield on a 10-year bond in July is 2.77 %. The central government has resorted to the issuance of special purpose bonds on two previous occasions, i.e. when the government recapitalised state-owned banks in 1997, and when the government established the China Investment Corporation in 2007.

Excluding corona bonds, central-government-issued debt in January-May amounted to 540 trillion yuan, increasing the credit stock to about 17 trillion yuan (18 % of GDP). At the end of June, local governments had bonds on issue worth a total of 24 trillion yuan (24 % of GDP). Local governments also engage extensively in off-budget borrowing.

Government bonds yields have risen since spring. On Wednesday (July 22), the rate on a one-year treasury was 2.24 %, up one percentage point from end-April. Rates on corporate bonds have also increased, due in part to the flood of the large amount of government paper onto the market. Chinese government bonds are considered to be risk free by investors.

Monthly bond issuances of Chinese local governments

Sources: China’s Ministry of Finance, CEIC and BOFIT.