BOFIT Weekly Review 17/2020

First-quarter figures show contraction in Russian foreign trade and net capital outflow

Preliminary balance- of-payments figures show that the value of Russian exports of goods and services amounted to 100 billion dollars in January-March, a 13 % y-o-y decline. Oil & gas exports slid by 25 % y-o-y in the wake of steep drop in price and declining demand. The value of other goods exports increased by 2 % y-o-y. Exports of services decreased due to COVID-19-related travel restrictions that reduced exports of travel services by 27 % y-o-y. The value of imports of goods and services amounted to 74 billion dollars, a decline of just over 1 % y-o-y. Imports of travel services fell by 16 %, while goods imports remained unchanged from a year earlier. The first-quarter current account surplus fell significantly on year, amounting to 22 billion dollars. The overall current account surplus for the past four quarters corresponded to approximately 3 % of GDP.

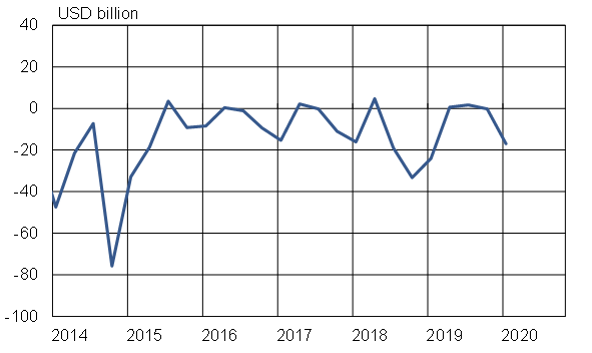

Looking at the financial account, there was again a corresponding net outflow of capital. Foreign investors sold their Russian sovereign bonds and repatriated portfolio investments from the non-banking corporate sector. The net flow of foreign direct investment into Russia also fell to nearly zero, and Russian banks continued pay down foreign debt. On the other hand, the first-quarter capital outflow was lower than in 1Q19 as Russian banks and companies made fewer investments abroad. The net capital outflow of the private sector amounted 17 billion dollars in the first quarter.

Net capital flow of Russian private sector

Sources: Macrobond and BOFIT.