BOFIT Weekly Review 14/2020

Mainland China stock markets perform relatively well, still capital is flowing from China

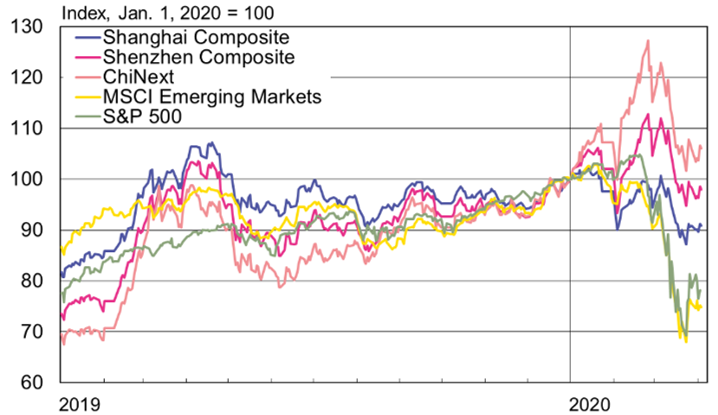

Despite the significant economic impact from the coronavirus crisis, Chinese stock markets have lately been outperforming most other major stock markets. On Friday (Apr. 3), the Shanghai Composite Index was down by 9 % from the beginning of the year, while the Shenzhen Composite Index was off by just 2 %. The Shenzhen exchange’s ChiNext index of growth com-panies has performed remarkably well of late and it is 6 % higher than in the start of January. In contrast, most global stock markets have seen large collapses in recent weeks. The US S&P 500 index, for example, is down by 22 % from the start of the year, while the MSCI Emerging Markets index is down by 25 %.

Trends in mainland China stock markets usually do not reflect the real economy outlook. Because market stability is a cornerstone of government policy, state-controlled operators can be ordered to support stock prices or at least refrain from selling shares at a time when share prices are plummeting. In addition, trading is dominated by small investors, which often display herd behaviour. Stock prices declined when traders returned from the extended Lunar New Year's holidays on Feb-ruary 3. After, during the three worst weeks of the coronavirus crisis, share prices rebounded by 10–20 %. As demand in real economy collapsed, some of the money injected appears to have flowed into the stock market. Stock prices fell again in March.

Shares on the Hong Kong Stock Exchange, which is open to foreign investors, have fallen more than shares listed on main-land China. On April 3, the Hong Kong exchange’s main Hang Seng Index was off by 17 % from the start of the year. The index of Mainland Chinese firms listed on Hong Kong was off 15 %. The prices of shares of companies listed on both main-land and Hong Kong exchanges have been significantly cheaper in Hong Kong for years, and are currently on average 28 % cheaper. According to media reports, shares of all these 119 dual-listed companies are currently cheaper in Hong Kong, some several times cheaper.

Foreign investors can trade on stocks in mainland China exchanges through the Stock Connect arrangements with the Hong Kong Stock Exchange. The outflow of capital through this channel has accelerated in recent weeks. In March, foreign investors sold more shares than they bought through Stock Connect. The net value of purchases (purchases minus sales) was -68 billion yuan (a drop of 10 billion dollars). In 2019, net purchases amounted to 349 billion yuan. Capital has also flowed out of China under the Stock Connect arrangement as Chinese investors have increased their holdings in Hong Kong shares. In March alone, Chinese investors’ net purchases in Hong Kong amounted 135 billion yuan (19 billion dollars). For all of last year, they totalled 246 billion yuan.

According to Dealogic data, the value of IPOs in mainland China in the first three months of this year amounted to rough-ly 11 billion dollars, more than in any other country. The biggest IPO (nearly 5 billion dollars) was the listing of the state-owned Beijing-Shanghai high-speed railway company on the Shanghai exchange at the beginning of January.

Stock market indices, 1.1.2019–3.4.2020

Sources: Macrobond and BOFIT.