BOFIT Weekly Review 11/2020

Russian government sector spending increased rapidly last year; oil price drop changes outlook

Growth in revenues to the consolidated budget (federal, regional and municipal budgets plus state social funds) slowed in 2019 to around 6 %. Growth in budget spending quickened to nearly 10 %, its fastest pace in many years. The budget surplus shrank somewhat, but still amounted to about 2 % of GDP (nearly 3 % of GDP in 2018).

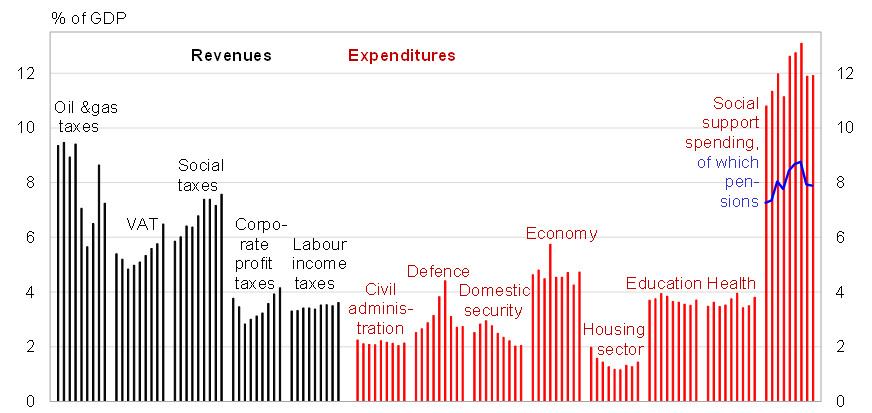

The slowing growth in revenues was due to an over 10 % decline in revenues from oil & gas taxes. Oil & gas taxes accounted for a fifth of total consolidated budget revenues, i.e. a decline to the 2015−2017 levels. Growth in other budget revenue streams exceeded 10 %, even if the pace slowed slightly. VAT revenues again increased rapidly (up 18 %), accounting for an increased share of 18 % of consolidated budget revenues. Growth subsided for revenues from social taxes based on wages, but they still accounted for a fifth of total budget revenues. Revenues from corporate profit taxes and labour income taxes increased by 10 %, but grew less rapidly than in 2018.

The fastest growing consolidated budget spending categories (each up well over 15 %) last year were the housing sector and various branches of the economy. The brisk rises of 2018 continued for spending on healthcare (up 14 %) and education (up 10 %). Spending on government administration rose by nearly 10 % for the second consecutive year. Growth returned to spending on defence and domestic security & public order, but stayed at 6 %. Growth remained rather moderate for spending on social entitlements, both with respect to pensions and other forms of social support.

The Duma approved changes to the federal budget and the state pension fund budget for 2020−2022 partly in response to president Putin’s promise to add to social support in his January speech to the Russian parliament. If regional and municipal revenue projections still are at the level of estimates made last autumn, consolidated budget revenues should rise by roughly 3 % this year on the above-mentioned changes and about 6 % a year during 2021−2022. Large part of the increase in revenue estimates for 2021 and 2022 derives from an increase in the CBR’s annual transfer from its surplus to the federal budget stemming from the government’s recent decision to buy the CBR’s majority stake in Sberbank to the government. The move is to be financed with assets from the National Welfare Fund. Consolidated budget spending should increase with the above-mentioned changes and last autumn’s regional budget spending projections slightly faster than expected late last year, i.e. 6.5 % annually in 2020−2022.

Based on the revenue and spending estimates, the view of a slight surplus in the consolidated budget is preserved (the federal budget surplus this year would be 0.8 % of GDP). The revenue projections, however, are based on an economic scenario criticised already earlier for being overly rosy (GDP growth of nearly 2 % this year and over 3 % from 2021 onwards). Moreover, the recent collapse in oil prices casts shadow over the budget’s oil price assumption, which this year is just under $58 a barrel (Urals crude). The slide in the ruble’s exchange rate caused by the drop in oil prices will soften the impact to the budget from the contraction in dollar-denominated oil & gas tax revenues, but it will still be insufficient to compensate for the negative impact of the drop in oil prices on the real economy. At an average price of $50 a barrel this year, the budget would go slightly into deficit under current spending projections. On the other hand, Russia already has a prodigious liquid asset buffer in the National Welfare Fund, as well as additional accrued oil tax revenues waiting to be transferred into the Fund. These assets altogether amount to over 9 % of GDP.

Largest revenue and spending categories in Russia’s consolidated government budget, 2011−2019

Source: Russian Ministry of Finance.