BOFIT Weekly Review 34/2019

Chinese economic growth continues to slow

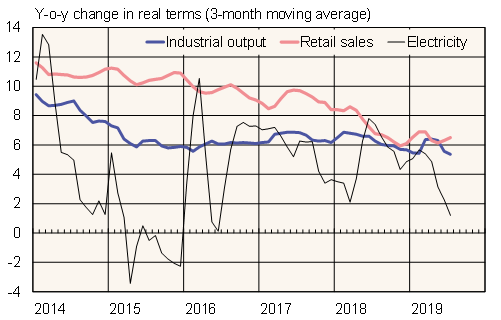

While the unreliability of official statistical data makes it difficult to assess actual economic conditions in China, numerous measures, including official figures, reveal a slowing trend in economic growth. In July, nearly all main indicators showed deteriorating conditions in China. The export figures of China’s neighbours also indicate weakening conditions in the region.

On-year growth in Chinese industrial output slowed from over 6 % in June to below 5 % in July. Notably, on-year growth in car manufacturing has been negative in every month for over a year according to the China Association of Automobile Manufacturers (CAAM). Manufacture of passenger cars was down 18 % y-o-y in July. Real growth in retail sales slowed over one percentage point to below 6 %.

The two main purchasing manager indices (PMIs) confirmed slowing growth. Both the official and private (Markit) manufacturing PMIs remained below the 50-point mark, which signifies the approach of industrial downturn. This year, the official PMI has climbed above the 50-point mark (i.e. rising production) only in March and April. While the services PMIs for both index producers fell from June to July, they were both still well above the 50-point mark.

Producers face the challenge of producer price deflation. In July, after a long slowdown, producer prices contracted by 0.3 %. It was the first time since August 2016 that there was an on-year decline in producer prices. Lower prices hurt corporate bottom lines, which in turn makes firms reluctant to invest. Consumer price inflation (2.8 %) was practically unchanged from the previous months.

China’s economic slowdown, combined with the negative impacts of the trade war on international production chains were evident in the value of exports to China from its neighbouring countries. In January-July, China exports were down sharply for Japan (down 9 % y-o-y), South Korea (down 17 %) and Taiwan (down 8 %).

Official NBS figures for Chinese output indicators

Source: Macrobond, BOFIT.