BOFIT Weekly Review 31/2019

Record FDI flows into China in the first half of 2019, but China’s FDI outflows continue to dwindle

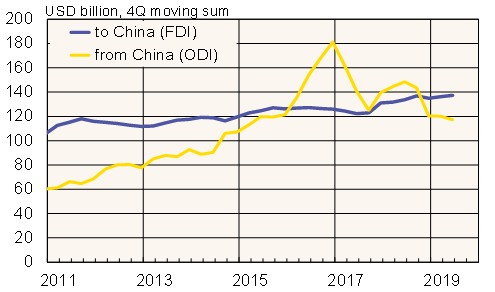

China’s commerce ministry reports that, despite uncertainty from the trade war, first-half foreign direct investment inflows into China (not including the financial sector) were bigger than ever – 71 billion dollars (up 4 % y-o-y). China’s outward FDI fell by 6 % y-o-y to 54 billion dollars. The ministry’s figures do not include financial-sector investments, which have corresponded to about a tenth of China’s outward FDI investment in recent years, and just a few per cent of FDI inflows to China.

Private western databases on Chinese outbound FDI confirm the decline in investment. According to the China Global Investment Tracker database, Chinese corporate FDI in the first half (27 billion dollars) was down by 50 % from the same period in 2018. Investment in Asia increased by nearly 50 %, while investment in all other regions declined. The value of investment flows to Europe were a tiny fraction compared to last year. The regional growth figures are sensitive to the timing of when large investments are recorded.

A joint survey of the Rhodium Group and the multinational law firm Baker McKenzie finds that Chinese FDI fell by 60 % y-o-y in the first half to about 20 billion dollars. Chinese investments in Finland were the largest of all European and North American countries as the exchange-listed Finnish firm Amer was acquired by Anta Sports for over 5 billion dollars the start of the year. In the first half of this year, Chinese corporate FDI flows to Europe fell to 9 billion dollars (-26 % y-o-y), but rose to 3 billion dollars to North America (19 %).

UNCTAD figures show that at the end of 2018, the stock of FDI in China amounted to 1.63 trillion dollars (5 % of global FDI). China’s global FDI stock amounted to about 1.94 trillion dollars (6 % of the global FDI stock). China last year accounted for 13 % of outward FDI flows globally.

China’s inward and outward FDI flows (excl. financial sector)

Sources: China’s Ministry of Commerce, CEIC.