BOFIT Weekly Review 28/2019

Russian economic growth driven almost exclusively by private consumption

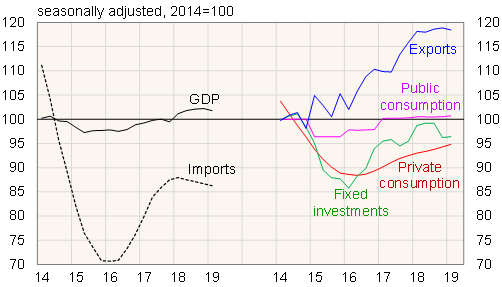

Newly released Rosstat figures show that the slowdown in GDP growth to just 0.5 % y-o-y in the first quarter was due to simultaneous weakening performance of both domestic demand and exports. The value-added tax hike at the start of the year had a one-time impact on domestic demand.

After several years of significant growth, the volume of exports stabilised last year and showed a small decline in the first quarter of this year. For the first time in three years, the volume of exports was slightly lower than in the same quarter a year earlier, but it was still up almost 20 % from the 2014 level.

Following a precipitous drop in 2015, private consumption gradually recuperated over the following two years. While continuing this year, the pace of recovery slowed in the first quarter. The slower growth picture for retail sales in recent months suggests that recovery in consumption may have cooled further. Private consumption in the first quarter was up about 1.5 % y-o-y, but still about 5 % below the level of 2014. Growth in public consumption in the first quarter remained at last year’s very slow pace.

Fixed investments recovered for about two years after their 2015 collapse, but last year growth flattened. Even with some growth in the first quarter of this year, the very weak investment performance in the final months of 2018 meant investments in 1Q19 were lower than in 1Q18, which was the first on-year drop in three years. Investments were also a few per cent lower than in 2014.

Imports of goods and services to Russia have contracted slightly in several recent quarters. In volume terms, imports were down slightly on-year in the first quarter and off by about 14 % from 2014.

Performance of real GDP, imports and demand, 2014–2019

Source: Rosstat.