BOFIT Weekly Review 27/2019

No big changes expected in China’s monetary policy

On Monday (Jul. 1) at a monetary policy conference arranged by the Bank of Finland, China’s central bank governor Yi Gang spoke on his nation’s economic conditions and monetary policy. Yi acknowledged the downward pressures on the Chinese economy, but said that the current monetary stance of “neither too loose nor too tight” will remain in place.

The monetary policy stance this year has not been eased much (BOFIT Weekly 22/2019). For several years now, the PBoC has sought to improve access to finance and lower the costs of financing for small firms. It will continue these efforts through the use of various monetary policy instruments. Opening of China’s financial sector will also continue.

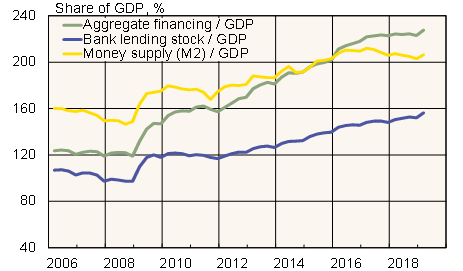

China’s monetary policymakers seek to hold growth in the broad money supply (M2), loan stock and aggregate financing to the real economy (AFRE) to the same pace as nominal GDP growth. China earlier talked about reducing its debt-to-GDP ratio, but current policy is aimed at just maintaining that ratio. In recent years, the stock of bank lending has grown a bit faster than official nominal GDP.

AFRE, bank lending stock and money supply trends

Sources: CEIC and BOFIT.