BOFIT Weekly Review 26/2019

London-Shanghai Stock Connect launches

On June 17, China’s financial markets took a small step towards internationalisation as the London Stock Exchange opened trading in depository receipts of Chinese firms. At the moment, however, foreign investors in London can only use the arrangement to trade in the depository receipts of a single Chinese company.

Unlike the Stock Connect programme that links the Hong Kong Stock Exchange with the Shanghai exchange, the London-Shanghai Stock Connect scheme relies on Global Depository Receipts (GDRs) issued by Chinese firms, while the listings of firms on the London exchange are based on Chinese Depository Receipts (CDRs) on the Shanghai bourse. The depository receipts represent ownership of ordinary shares of a foreign corporation and can be traded like regular shares. The custodian bank issues the depository receipts against the actual shares of the firm in its possession. The advantage of trading in depository receipts is that it removes the need for direct trading infrastructure between exchanges and eliminates such issues as time differences. The trading is subject to the rules of both exchanges. In Shanghai, trading is denominated in yuan and in London in dollars, pounds or yuan.

To launch the London-Shanghai Stock Connect, the Chinese brokerage Huatai Securities raised 1.5 billion dollars (about 9 % of the company’s share capital) through the issue of depository receipts on the London exchange. No firm listed on the London exchange has yet issued depository receipts in Shanghai.

The Stock Connect rules are strict, so only a small number of exchange-listed firms are qualified to participate. For this reason, the arrangement is not expected to do much to increase the prospects of Chinese firms seeking foreign financing. Trading in both directions is subject to quotas and private Chinese investors cannot participate in the scheme without a large enough investment capital. Trading activity is expected to remain relatively modest, and the programme could end up being mostly a symbolic gesture.

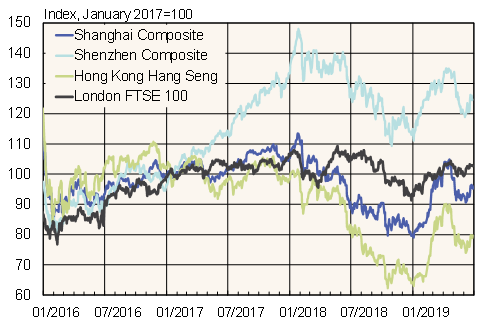

Share price trends in mainland China, Hong Kong and London

Sources: Macrobond and BOFIT.