BOFIT Weekly Review 25/2019

Rapid expansion of Russian consumer borrowing raises concerns

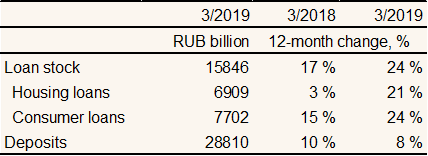

Preliminary data released by the CBR show that on-year growth in the stock of credit granted to households accelerated in the first four months of this year. The credit stock, which grew at less than 20 % y-o-y in spring 2018, increased by 24 % y-o-y this April.

The acceleration in growth of unsecured consumer credit to its current pace of over 25 % y-o-y is seen as a particular cause for concern. Nominal wages in Russia are only rising at about 7 % y-o-y and real incomes continue to shrink. Consumer loans represent about half of household borrowing. The CBR has sought to moderate credit growth by e.g. though several hikes in the risk ratio buffers for unsecured credit and by announcing its willingness to increase requirements further if needed. From the beginning of October, banks granting new loans will have to determine the debt burden ratio on each loan applicant (ratio of total credit-servicing costs to the previous year’s average monthly earnings).

The growth in housing loans is seen as less of a cause for worry than that of consumer loans, but the increasing loan-to-value ratios (ratio of mortgage amount to appraised value of property) have raised some questions. At the beginning of January, the CBR increased risk ratio buffers for highest-risk housing loans (loan-to-value ratios above 80 %), thereby slightly increasing interest rate on these loans. The loan-to-value ratio for about 40 % of housing loans granted during the first months of this year exceeded 80 %. At the same time, the average size of a housing loan has risen. Approximately 400,000 new housing loans were granted in January-April, which was slightly fewer than in the same period in 2018. The average interest rate on new housing loans is currently just under 10 %.

Less than 1 % of household loans are denominated in foreign currency. About 20 % of household deposits are in foreign currency.

Household borrowing and deposits

Source: Central Bank of Russia