BOFIT Weekly Review 17/2019

Russia’s foreign debt up slightly in the first quarter

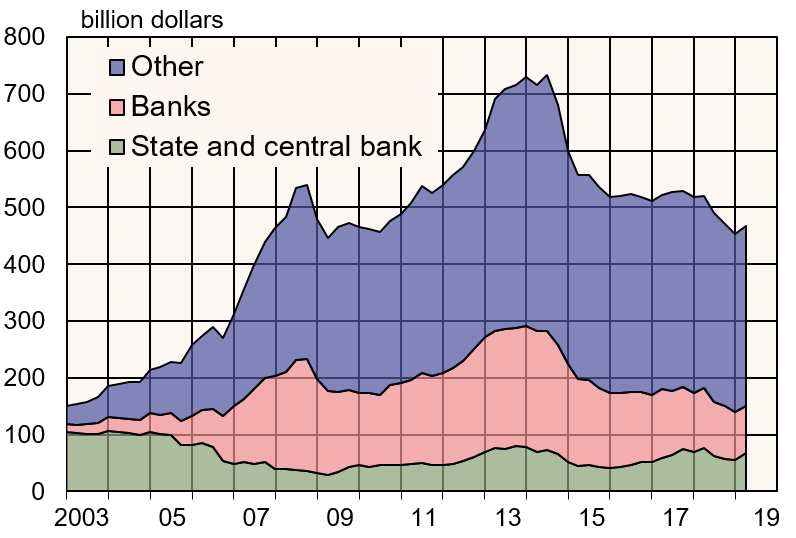

Growth in Russia’s foreign debt basically came from government foreign debt. Russia’s foreign debt is held mainly by non-bank corporations, banks and the government. Foreign debt has declined from a mid-2014 peak of about 733 billion dollars to around 468 billion dollars at the end of March.

Russians have reduced their foreign debt since the 2014 peak, mainly by paying down debt, due to sanctions and Russia’s weak economic performance. Russians also paid down foreign debt during the 2009 financial crisis. However, the level of indebtedness at that time recovered rapidly after the crisis. The impact of sanctions is most evident in the continuous reduction of foreign debt of Russian banks. Russia’s largest banks, which include giant Sberbank and VTB, are not able to get any new long-term financing from EU countries or the US.

At the end of March, the Russian government’s foreign debt amounted to little over 53 billion dollars (11 % of total foreign debt). Banks owed over 82 billion dollars (18 %). Other sectors, mainly corporates outside the financial sector, owed about 318 billion dollars (68 %) to lenders abroad. Of that, 142 billion dollars was intragroup debt, i.e. debt owed between parent and subsidiary companies of the same corporate group.

Russia’s foreign debt, 2003−2019

Source: Central Bank of Russia.