BOFIT Weekly Review 49/2018

Markets reacted cautiously to Trump-Xi truce

Given the low expectations going into the G20 summit that the US and China would make progress on resolving their trade differences, the 90-day postponing of further sanctions was enough for both sides to put a positive spin on their meeting. Market reactions in China and the US, initially positive, grew more pessimistic as the week progressed, partly with news of the US-ordered arrest in Canada of Huawei CFO, Wanzhou Meng on December 1.

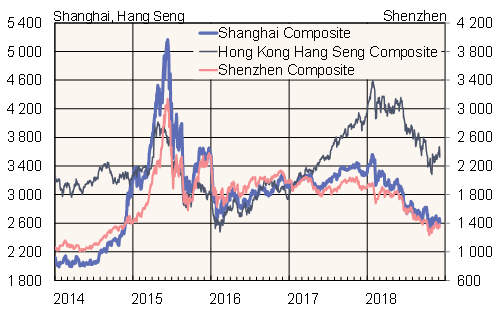

In the wake of the summit on Monday (Dec. 3), prices on the Shanghai stock exchange rallied nearly 3 % from their Friday levels, only to fall slightly later in week. Chinese stock performances this year have generally been weak, so the hoped-for injection of optimism gave way on Tuesday (Dec. 4) to uncertainty over the feasibility of resolving complex trade issues in a brief period. On forex markets, the yuan was up over 1 % against the dollar, only to weaken again to around 6.88 by Friday (Nov. 7).

Last week’s publication of the official purchasing managers’ index indicated that industrial output growth halted in November, adding to market jitters.

Mainland China and Hong Kong share indices

Sources: Macrobond.