BOFIT Weekly Review 46/2018

Retail sales in China slide below GDP growth target

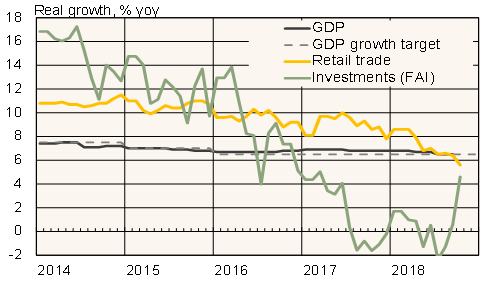

Retails sales, considered the most important indicator of private consumption in China, grew by less than 6 % y-o-y in real terms in October. The growth figure includes the booming online shopping trade, which now accounts for over 17 % of all sales of consumer goods. A year ago, growth in retail sales was close to 9 % y-o-y.

On-year growth in fixed asset investment (FAI) in urban areas instead accelerated on revived growth in public and private investment. This is partly the result of orders from the central government that local governments complete unfinished infrastructure projects. The apparent recovery also reflects the modest basis for comparison at the end of last year.

FAI and retail sales are the most important indicators of current domestic consumption available as the National Bureau of Statistics publishes figures on fixed investment and consumer demand consistent with its GDP methodology only on the annual level. According to official figures, Chinese GDP grew in July-September 6.5 % y-o-y. Notably, slowing growth in both FAI and consumer demand appear to be running lower than GDP growth. Moreover, the shrinking of the foreign trade surplus suggests that net exports depress rather than fuel growth at the moment.

China’s official GDP figures seem not to be troubled by movements in the core demand indicators, however. They merely track growth targets laid out by the party.

China’s GDP and major demand indicators

Sources: Macrobond and BOFIT.