BOFIT Weekly Review 36/2018

Changes in structure of fixed investment in Russia

Fixed investment rose by over 3 % y-o-y in the first half of this year, even if investments of large and mid-sized firms and the state, which are in the core of statistical recording of fixed investment, fell by 1 %. Thus, Rosstat figures imply an unusually large increase (well above 10 %) in fixed investment activity by small firms, firms operating in the grey economy and households.

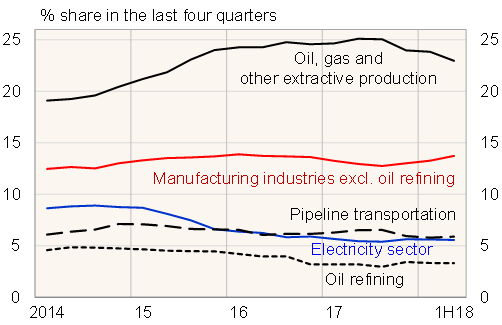

Fixed investment by large and mid-sized corporations was drawn down by all significant categories of the energy sector. The multi-year decline in investment in the electricity sector continued, while investment in pipelines for the oil & gas sector dipped. Investment in oil production and oil refining turned downwards. The large investment wave in services related to gas production and transportation on the Yamal Peninsula came to a near complete halt. Manufacturing investment (excluding fixed investment in oil refining) rebounded strongly after a three-year decline. Much of the recovery reflects investment in the chemical industry and manufacturing of transport vehicles.

Looking at investment in various types of physical capital, growth of investment in machinery and equipment has remained brisk this year. In contrast, investment in various kinds of structures has declined, supporting the picture that the peak in various large investment projects, some of them government-led, has now passed.

Structure of fixed investment of large and mid-sized firms and the state

Source: Rosstat.