BOFIT Weekly Review 18/2018

Higher foreign investor quotas for Chinese stock markets

The daily net purchase quota for foreign investors on the Shanghai and Shenzhen exchanges under stock connect arrangements with the Hong Kong stock exchange was quadrupled on May 1 to 52 billion yuan (USD 8 billion). Similarly, the allowed daily net purchases of Chinese investors on the Hong Kong exchange was quadrupled to 42 billion yuan. In mainland China, access to the Hong Kong stock exchange via stock connect is limited to large investors (investment assets over RMB 500,000 or about USD 80,000).

The increased quotas reflect last year's decision by share index publisher MSCI Inc. to include mainland China shares in its indices from the start of June (BOFIT Weekly 25/2017). Even if a large share of the China-weighting in indices will still come from Hong Kong-listed shares and the weighting of shares listed on mainland exchanges is marginal, many believe that the index reforms will increase trading under stock connect programmes.

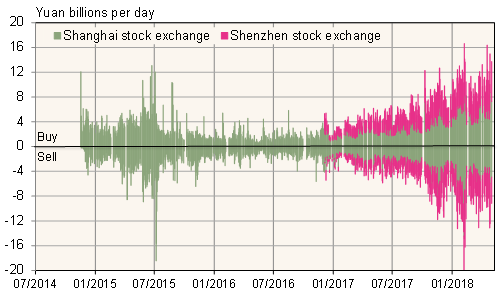

The increased quotas, however, are of minor practical significance; purchases by foreign investors via the Shanghai exchange this year under stock connect has averaged just 5.7 billion yuan a day with sales of just 5.1 billion yuan. In other words, average net purchases rarely even approach the old daily quota of 13 billion yuan.

Foreign investor trading via the stock connect programmes on mainland exchanges has nevertheless increased. An average of 1–2 % of the Shanghai exchange's trading volume was generated by the stock connect programme between its launch (11/2014) and last summer. Since then, the stock connect share has risen to around 5 %. About 3 % of the Shenzhen exchange's trading volume is generated by the stock connect for foreign investors. The amount of Chinese investor trading under stock connect arrangements with the Hong Kong exchange has been roughly similar in value to foreign investor trading with mainland China bourses. Trading via the stock connects this year has accounted for an average of 13 % of the Hong Kong exchange's trading volume.

Overall, foreign ownership in mainland Chinese stock markets (through both stock connect and QFII and RQFII programmes) at the end of March was just 1,202 billion yuan, or 2 % of the exchanges' combined market capitalisation.

Trading volumes under stock connect programmes in mainland China stock exchanges

Sources: CEIC and BOFIT.