BOFIT Weekly Review 2017/13

No decision yet on extending Russian oil production cuts

Late last year, OPEC and eleven non-OPEC countries agreed, under a voluntary arrangement, to cut their production in the first six months of this year by a total of nearly 1.8 million barrels a day (mbd). The committee tracking the agreement's implementation said last week that the total production of participating countries had dropped nearly as much as planned. The committee did not give yet any recommendation whether the cuts should be extended to 2H17.

Russia committed to reducing its output gradually to a total of 0.3 mbd from last October's level. Russian energy minister Alexander Novak reports that Russia had agreed to reduce output by the end of March by 0.2 mbd and that late last week the realised reduction was 0.185 mbd.

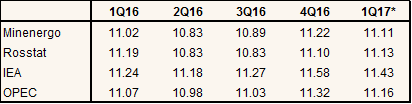

Due to varying methodologies applied in the statistical data on oil, it is difficult to track precisely whether Russian oil output is declining as agreed. However, according to most data sources production in January-February was 0.12–0.15 mbd lower than in record-breaking peak of October 2016. While January-February output was lower, it was up on year. Moreover, it is difficult to distinguish to what extent production declines are due to an actual cut or normal seasonal fluctuations.

While complying with the agreed reductions in output could be important for Russia-OPEC relations, the direct impact on global oil markets is small. Global oil production averaged about 96 mbd in February, so Russia's promised cuts amount to just 0.3 % of that. In recent weeks, oil prices have fallen a bit, due to e.g. higher levels of production and higher inventories in North America.

Russian oil production (incl. condensates), mbd

* For Minenergo and Rosstat Jan-Feb realised, IEA and OPEC 1Q estimates