BOFIT Weekly Review 04/2017

Central bank of China boosts liquidity of money markets ahead of New Year's holiday week

The People's Bank of China has increased the money supply via open market operations, credit instruments and special arrangements ahead of the week-long Lunar New Year holiday that starts today (Jan. 27). Media reports note that the reserve requirements on large banks have also been eased temporarily to prevent excessive tightening in money markets.

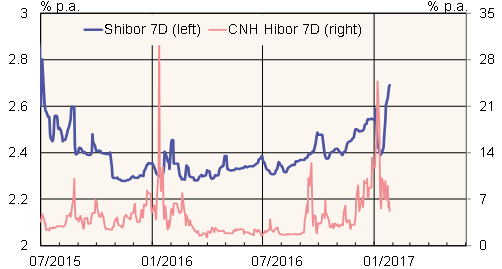

In contrast, the PBoC's 10 basis point hike in rates on its medium-term lending facility (MLF) loans to commercial banks on January 24 has increased costs of long-term funding and signals a tightening in the monetary stance. The interest rate charged on a one-year MLF credit rose to 3.1 %. Market interest rates in China have been rising for a while.

Interbank yuan rates: Shanghai (Shibor) and Hong Kong (Hibor)

Source: Macrobond.