BOFIT Weekly Review 4/2017

Chinese credit stock continues to rise faster than output

The stock of bank loans issued in yuan increased by 13.5 % last year, even if the pace of growth slowed slightly from 2015. Growth in the corporate loan stock slowed, but the pace at which new loans were granted to households increased to over 60 %. The share of new household loans rose from a third in 2015 to half of all new loans made last year. About 80 % of household loans are housing loans. The stock of loans denominated in foreign currencies continued to diminish.

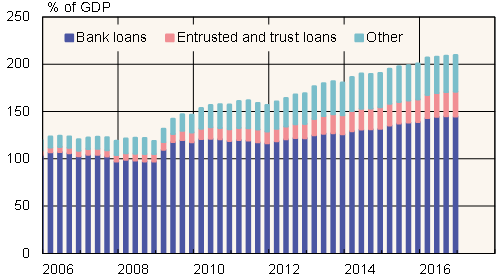

Under the central bank's broader definition of credit, total social funding (TSF), the credit stock (domestic borrowing of households and businesses, excluding financial sector) grew 13 % last year, rising to 210 % of GDP. The stock of shadow banking sector's trust and entrust loans grew by 19 %, while the stock of bank acceptance bills declined sharply. In lieu of bank loans, firms increasingly sought to raise money through bond issues. In December, however, corporate bond issues fell and the use of shadow banking instruments increased.

China's domestic debt (excl. central and local government debt)

Sources: CEIC, BOFIT.