BOFIT Weekly Review 47/2016

Payment delays on the rise in China

It now takes exchange-listed firms over 90 days on average to receive payment from their customers. In 2011, the average payment time was under 60 days. Since then, the average payment delay has increased by about one week each year. The last time the belated payment situation was this bad was after the Asian financial crisis of the late 1990s. The industrial sector has the longest payment times.

The late payment problem has forced many Chinese firms to sell their invoices to third-party finance firms or banks. In exchange for quick cash, the firms surrender a portion of the invoice to the factoring firm. For example, construction equipment manufacturer Sany has reportedly sold payments receivable to factoring firms for 9 % below their face value.

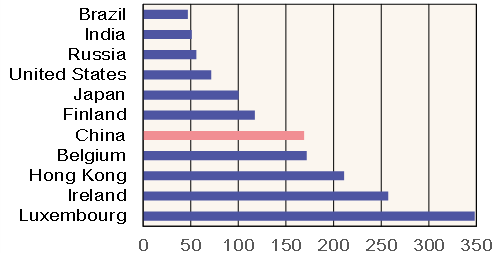

Figures from the Bank for International Settlements (BIS) show that the debt burden on Chinese firms is among the highest on earth relative to the size of the economy. Drawn-out payment times, decelerating economic growth and the ongoing structural change make it more difficult for many firms to service their debts. Non-performing bank loans (NPLs) are on the rise, even if banks claim the problem is small. Many observers note that the actual NPL problem is much more serious than banks are willing to admit.

Corporate debt (excl. financial sector), % of GDP

Source: BIS.