BOFIT Weekly Review 43/2016

Bleak outlook for Russia’s government finances

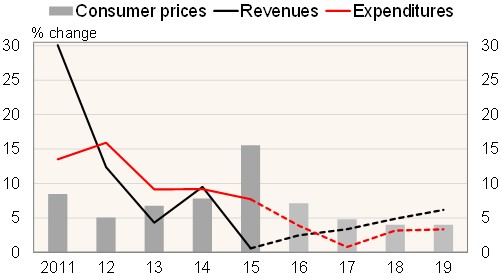

In its fresh budget policy framework for 2017‒2019, the finance ministry sees revenues to the consolidated budget (federal, regional and municipal budgets, and government social funds) still failing to keep up with inflation next year. The estimate cautiously assumes a price of Urals-grade crude oil of $40 a barrel for the whole period, which equals the average of January-September of this year. The ruble’s exchange rate, which also affects tax revenue from oil, is assumed to weaken slightly. Other revenues are expected to slightly outpace inflation next year. To mend the revenue side, the government plans to treat the income (nearly 0.9 % of GDP) raised from the sale of a 19.5 % stake in state oil giant Rosneft as budget revenue, although by nature that income is a financing item to cover the budget deficit. It would be channelled to the budget as dividend income from the state-owned firm selling the Rosneft stake. The sale could be completed this year.

The ministry expects low government spending growth in coming years as targets have been set to shrink the deficit. The 2017 growth figure is also depressed by this year’s abrupt spending boomlet caused by the 2016 supplementary federal budget (currently in the Duma) that boosts defence spending by a whopping 0.9 % of GDP. The ministry now estimates the government budget deficit will reach 4 % of GDP this year even if the Rosneft deal goes through, and 4.8 % of GDP without the deal. Next year’s targeted deficit is 3 % of GDP.

Changes in government revenues and expenditures, and inflation rate, 2011‒2019 (2016‒2019 are finance ministry estimates)

Source: Ministry of Finance.