BOFIT Weekly Review 40/2016

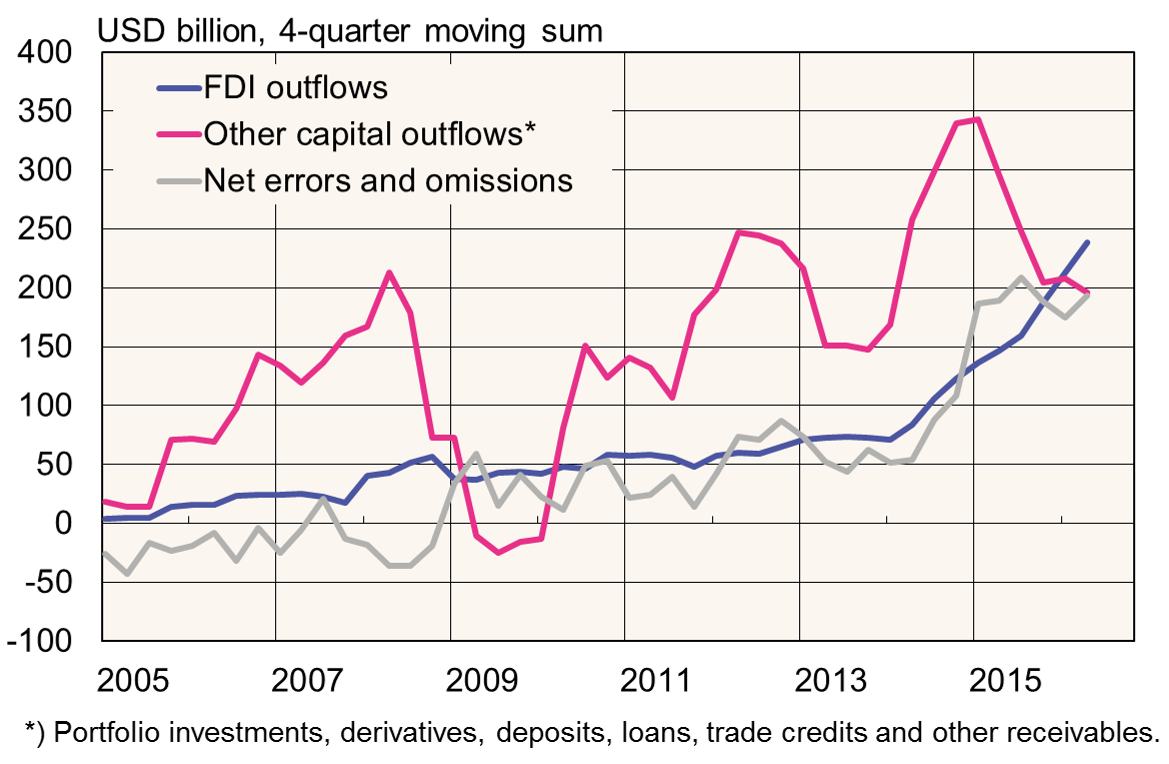

Capital outflows from China strengthen

Balance-of-payments data for the first half of 2016 show capital outflows from China amounted to $236 billion, while capital inflows were just $64 billion. Thus, the financial account deficit (changes in currency reserves not included) was $172 billion. In contrast, the current account still showed a strong surplus, but the PBoC, especially in January, still had to sell currency from its reserves to calm forex market worries about yuan devaluation.

In the first half, about half of capital outflows from China were direct investment or comparable capital flows (e.g. intragroup corporate financial arrangements). Chinese also actively lent to borrowers abroad and increased other receivables from abroad. The net errors and omissions term in the balance-of-payments figures, which indicates unreported cross-border money transfers, suggests heavy capital outflows.

The increase in capital outflows from China reflects several factors. The lift of capital controls is China has allowed capital flows to increase. Measures to increase international use of the yuan through the creation of offshore trading centres have supported these outflows. In addition, the slowdown in economic growth and increased risk have made investment abroad more attractive to Chinese investors.

Capital outflows from China

Sources: Macrobond and BOFIT.