BOFIT Weekly Review 40/2016

Yuan becomes part of IMF’s SDR currency basket

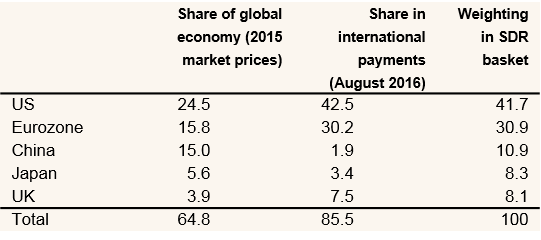

The addition of the yuan to the IMF’s Special Drawing Rights (SDR) currency basket last Saturday (Oct. 1) went smoothly and generated little market reaction this week. The IMF announced its decision to make the yuan an SDR currency in November 2015. Addition to the currency basket is a largely symbolic recognition of the opening up of China’s financial markets to the world and increased international yuan acceptance. In China’s domestic policy, SDR status has helped in the push for key domestic financial market reforms. The yuan has an 11 % weighting in the revised currency basket, which is significantly more than the yuan’s current use in international payments. The yuan plays an important role in Asia, however. SWIFT figures show the yuan is used in 45 % of international payments in Asia and the Pacific region that involve China (includes Hong Kong). In Europe, the share of yuan in China transactions already exceeds 30 %, while in Americas it is still less than 5 %.

The SDR is the IMF’s reserve asset and accounting unit, which value is based on a basket of currencies. The SDR is used in lending of the IMF and a small part of member state currency reserves is in SDRs. The interest rate charged on IMF loans and SDR deposits are based on average national interest rates of SDR currencies.

Economy size, use in cross-border payments and weight in SDR basket, %

Sources: IMF and SWIFT.