BOFIT Weekly Review 39/2016

BOFIT Russia forecast sees slow recoveries for the economy and imports

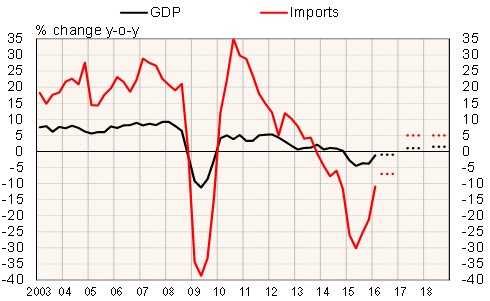

The GDP contraction in the first half was mild (less than 1 % y-o-y), given that the oil price was 30 % lower than in 1H15 and over 60 % lower than in 1H14. The decline has been softened by a rise in oil prices this year and a large fall in imports caused by a weak ruble. As in 2014–2015, this year’s decline in imports has been very steep relative to the drop in GDP.

Our latest Forecast for Russia for 2016–2018 assumes an average oil price this year below $45 a barrel (17 % below 2015) that gradually rises to $55 in 2018. The GDP is projected to shrink 1 % this year, while imports will fall about 7 %. Rising oil prices will gradually revive the GDP in 2017, but growth will be slow, due e.g. to underinvestment now and in the next few years at least. A decisive lift in growth could result if Russia refocused its policy emphasis to market-friendly systemic reforms and away from the currently creeping restrictions that erode the functioning of markets.

Imports start to revive in 2016–2017 as the economy recovers, the rise of oil prices lifts Russia’s export earnings, and the ruble’s real exchange rate gradually rises. However, imports will grow moderately. Their share in the economy still now is as large as it was in 2013 before the slide began.

The gradual slowdown in inflation will support a recovery in private consumption. On the other hand, consumption growth will be limited by modest productivity gains that only permit small wage hikes, and by the continuance of current strict policies on public sector wages and pensions. The volume of Russian exports will recover but grow slowly, if the expected mild contraction in oil sector exports materialises. As with other investments, the investments of export firms remain limited by uncertainty over the economy and the poor business environment.

The weak outlook for government finances will also retard economic recovery. Budget revenues are expected to rise only slightly faster than the inflation rate. The downward slide of spending in real terms should moderate from this year, but will continue if the leadership sticks to its announced targets to shrink the budget deficit. The possibilities for relaxing monetary policy seem limited in light of the set inflation target. It is also unclear how strongly monetary easing would affect real interest rates or corporate borrowing due to economic uncertainty.

Large risks to the forecast persist. They mostly relate to the oil price and geopolitical tensions, and consequently the ruble’s exchange rate, inflation, imports and government finances. The recovery in imports could be more rapid than our forecast (as occurred after Russia’s previous recessions). On the other hand, Russia could impose further restrictions on imports. Given the drop in living standards the people have endured, and with political pressures possibly sprouting, budget policies might be relaxed.

Real change in Russian GDP and imports

Sources: Rosstat, BOFIT Forecast for Russia 2016–2018.