BOFIT Weekly Review 38/2016

Consumption continued to fall in Russia in August; production picked up slightly

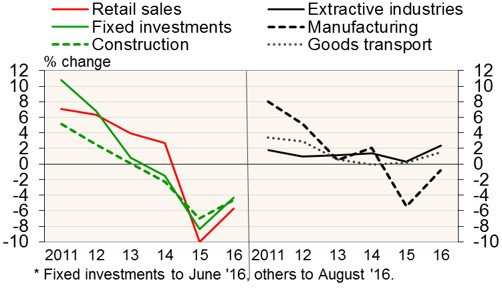

The volume of retail sales (seasonally and workday-adjusted) has fallen for 20 consecutive months. Retail sales were down 5 % y-o-y in August, or about the same as in July and slightly less than in the first and second quarters (down 6 % y-o-y). From the beginning of spring the drop has been approximately the same for sales volumes of both food and non-food goods. Real household incomes continued to decline in August (incomes have been in decline since late autumn 2014).

In contrast, seasonally and workday-adjusted industrial output increased on-month in August – the third month of growth this year. Industrial output was about the same as in March and April, and up 0.7 % from August 2015. The mining and mineral extraction sector (which includes oil & gas) saw a slowdown, with output up less than 2 % y-o-y. The downturn largely reflects a drop in crude oil production for the first time this year to a level about the same as a year ago (production growth had been strong this year up to July). Natural gas production in August was up for the first time this year.

Following a weak performance in July, manufacturing output increased significantly in August, with production climbing back to the same level as August 2015. Among the most important manufacturing branches, output of foodstuffs, chemicals and rubber and plastics products experienced accelerating growth.

The slide in construction began to level off as summer progressed. July-August construction activity was only down about 3 % y-o-y. Growth in farm output picked up towards the end of the summer. Production growth was up 5–6 % y-o-y in July-August. Much of the increase came from larger grain harvests – grain harvests at the beginning of September were about 25 % higher than at the same point in 2015.

Real 12-month change in economic core sectors

Source: Rosstat.