BOFIT Weekly Review 31/2016

Oil price down sharply in July, ruble follows

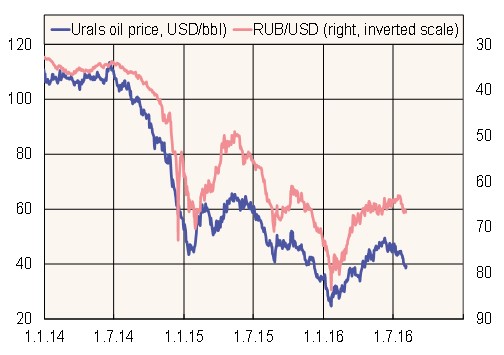

Global crude oil prices hit their peak this year early in June, when the price of Urals-grade crude approached the $50-a-barrel mark. The oil price has since fallen, and in July the decline accelerated. Over the past month, the price of oil fell by more than 15 % and the current price of Urals-grade crude is slightly below $40/bbl. Oil futures suggest the price should rise by around $3/bbl by the end of the year. Urals hit a low this year of about $25/bbl in January.

Changes in the oil price are rapidly reflected in the ruble’s external value. When oil prices rose this spring and early summer, the ruble’s exchange rate strengthened. When the price of oil fell in July, the ruble shed about 4 % of its value against the US dollar.

Urals oil price and ruble-dollar exchange rate

Source: Reuters

A crucial issue for Russia’s public finances is the oil price in rubles. As a rule, ruble depreciation cushions the budget impacts of a drop in the dollar price of oil. In recent weeks, however, the crude oil price in rubles has fallen sharply, because ruble depreciation has been less than the drop in oil prices in dollars. At the moment, a barrel of Urals-grade crude oil costs approximately 2,600 rubles. This year’s budget assumes an average oil price in 2016 of 3,165 rubles a barrel. At that price, the public sector deficit this year would be about 3 % of GDP.