BOFIT Weekly Review 30/2016

Slight bump in Chinese share prices

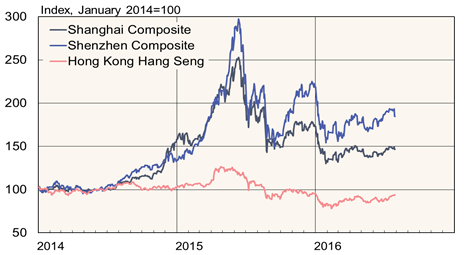

Even with the fall on Wednesday, stock indexes in Shanghai and Shenzhen are few percent up over the two months, but are still considerably lower than at the start of the year. Media reports suggest that new large institutional investors are coming to the Chinese stock market, as China’s pension funds are finally starting their investment in shares, decided last year. Pension funds hold assets of about 2 trillion yuan (€270 billion), but only a fraction of that will be invested in local equity markets. The investment will be made over several years via the national social security fund. A goal of reinvesting pension assets is to improve the return on fund investments. China’s undeveloped stock markets have been volatile in recent years, seesawing far more than the economic development would suggest. One possible explanation is the lack of large institutional investors to anchor the markets. The entry of pension funds into the market might slightly calm share price volatility.

Predicting profit of listed Chinese firms has proven a non-trivial task. A recent Bloomberg assessment found that per-share earnings of Chinese listed companies have been running about a third less that market analysts had forecast. Many of China’s largest listed firms are involved in heavy industry. While China seeks to transform its economy to a more consumer-oriented, service-driven economy, firms in industrial branches suffering from overcapacity have seen their profitability weaken much more than analysts expected.

Main stock index performance in China and Hong Kong

Sources: Macrobond and BOFIT.