BOFIT Weekly Review 30/2016

Increase in profits of Russian firms supports capital flows abroad and to banks

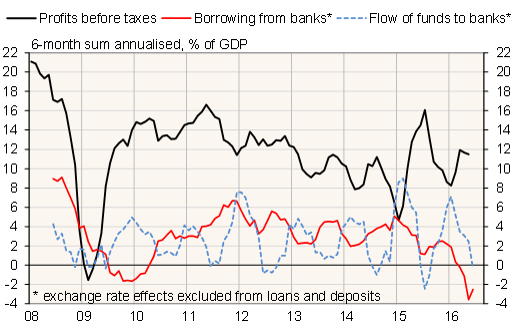

Despite a recessionary economy, profits of Russian companies were up again in January-May relative e.g. to companies’ business turnover and GDP. Profit data is based on Rosstat figures that aggregate firm-level numbers determined according to Russian bookkeeping standards. By that measure, profits have risen to levels not seen since 2012−13. The surge in profit this year reflects another slide in the ruble’s exchange rate. The ruble fell rather continuously from summer 2015 to early 2016, which fuelled profits of export firms, in particular. The largest sums of profits were seen in almost all of the same branches as in early 2015, i.e. oil production, metal refining, chemical production and wholesale activities. Food industry profits were also up. Not surprisingly, these fields are also among the most profitable in Russia.

Higher corporate profits have yet to induce a recovery in domestic investment. Even if far less than in previous years, flows of outbound corporate sector assets have remained quite notable this year and last. Outbound flows have consisted mainly of direct investment and granted credit.

Otherwise, companies have shifted a couple of times the focus of their assets allocation to financial activities during this recession. In the first half of 2015, firms concentrated on paying down foreign debt. In the second half of 2015, the focus was on restoring their funds at banks. The theme of the first half of 2016 was reducing indebtedness to domestic banks. Reminiscent of the behaviour of households last year, companies became net lenders to banks.

Corporate profits and flows of their bank assets and credit

Sources: Rosstat, Central Bank of Russia and BOFIT.